MobLab offers several economics simulations for teaching students about behavior under uncertainty, such as our Bomb-Risk, Insurance Market, and Asset Market games. However, did you know that MobLab also features pre-made surveys for risk preferences that can complement those simulations?

These simple, yet powerful, surveys can help students easily understand what can often be a complicated subject. Even better, these surveys can be used in live teaching environments or asynchronously.

Let’s dive into a couple of these pre-made risk preferences surveys to see what they’re all about and how they can be used with your class.

Risk Preferences: Binswanger/Eckel and Grossman

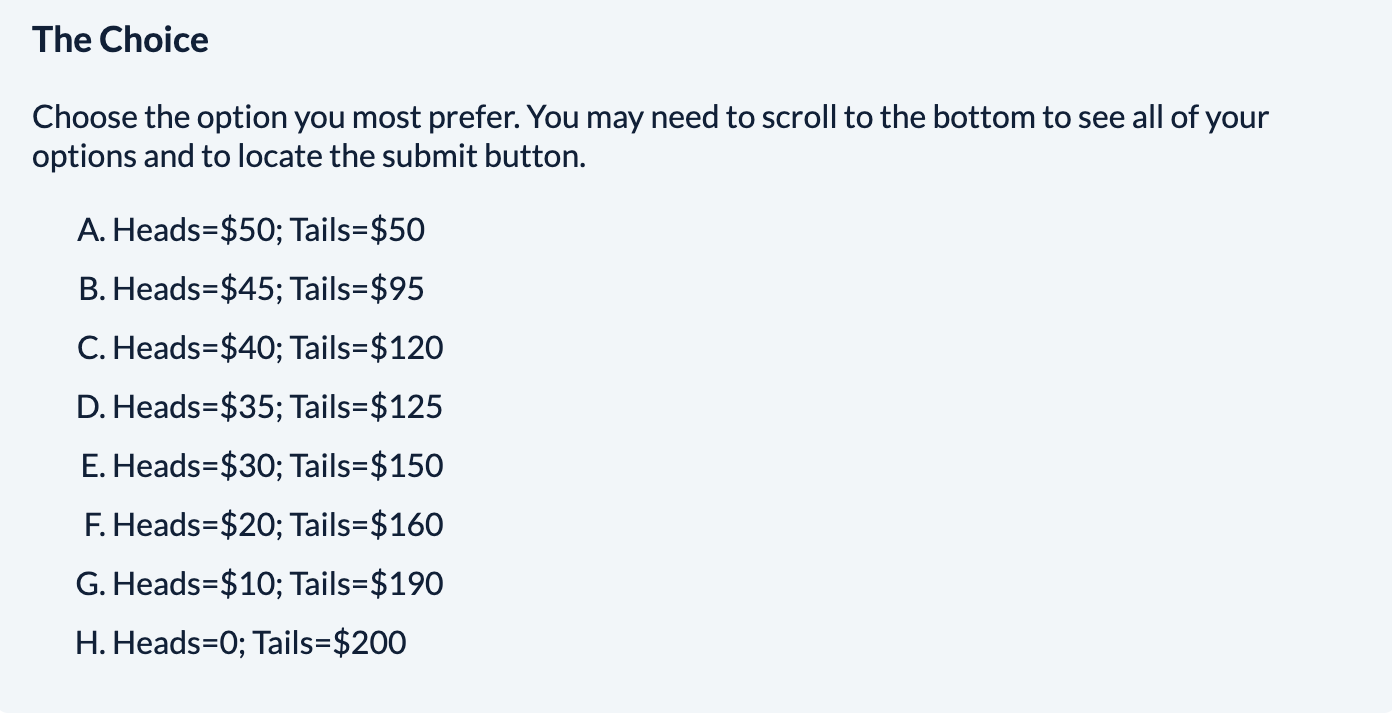

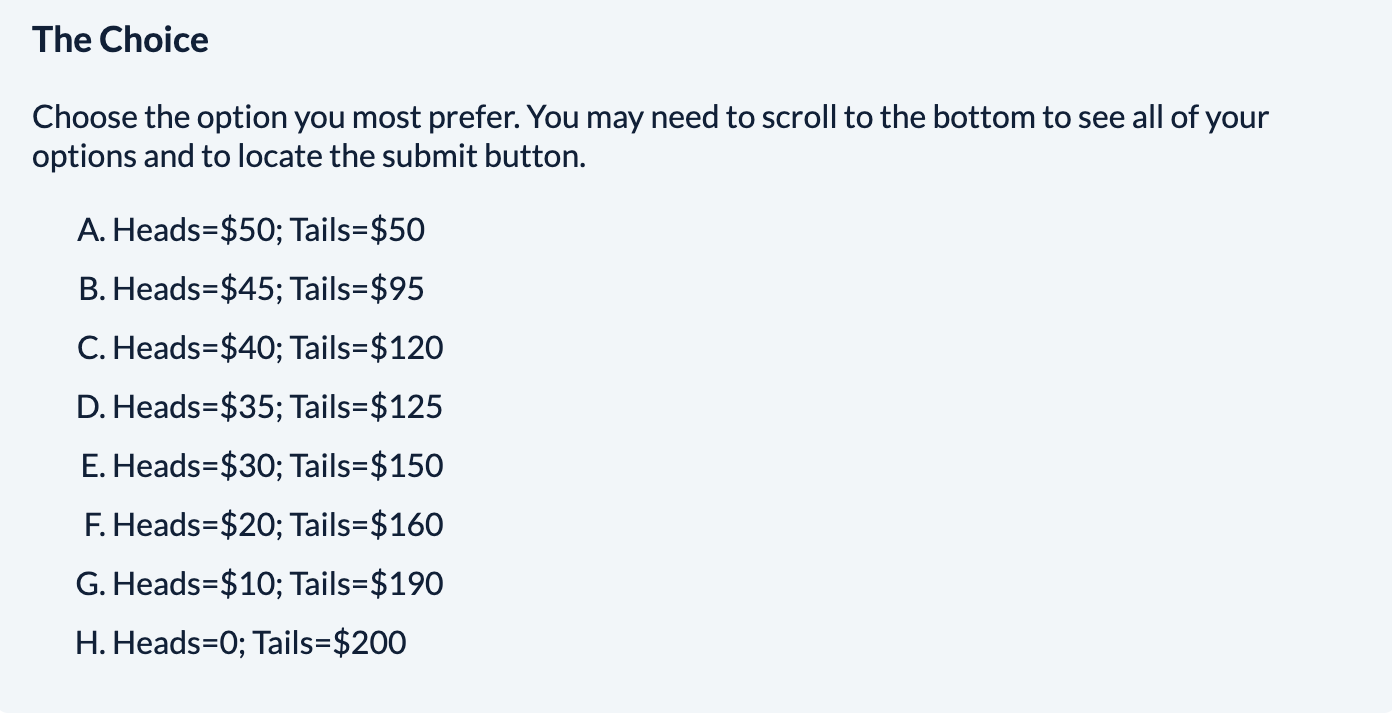

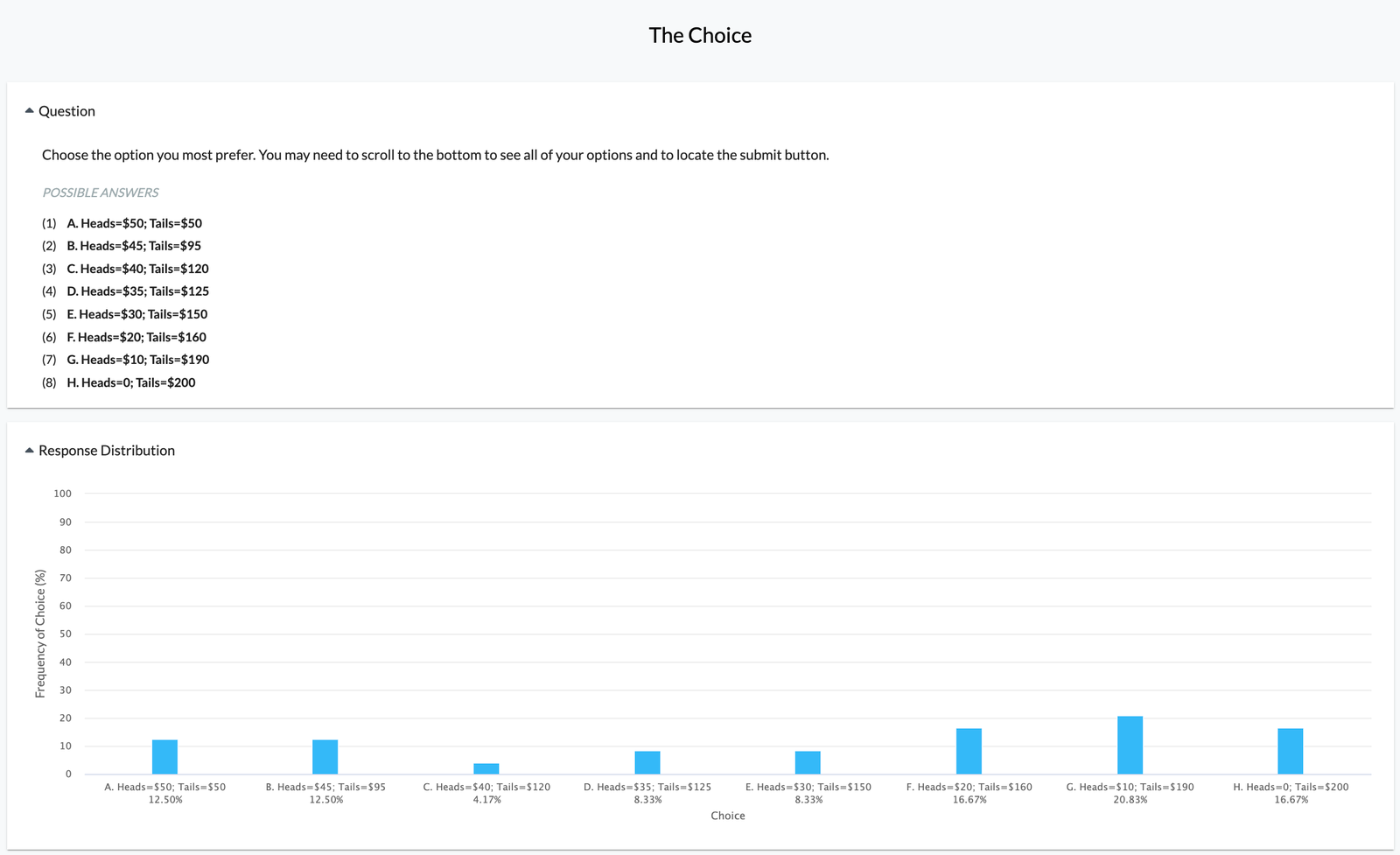

Inspired by Binswanger (1980), this pre-made survey measures students’ levels of risk aversion by asking them to choose one of eight payoff options in a fair coin toss. The first option contains no risk. The subsequent choices increase in riskiness and expected value.

Choosing from MobLab's Binswanger Survey Options

As the outcomes become riskier with the expected value of the payoff option also increasing, the distribution of your students’ choices highlights that risk preference (i.e., preferences over the goods of expected payoff and safety) vary across individuals. You should therefore expect a wide distribution of answers when viewing the survey’s post-game results, with earlier-letter choices consistent with more risk aversion and the later-letter choices more risk tolerant.

Using the results from the survey saves you lecture time, and gives students a graphical breakdown of the class’s choices.

Risk Preferences: Holt Laury

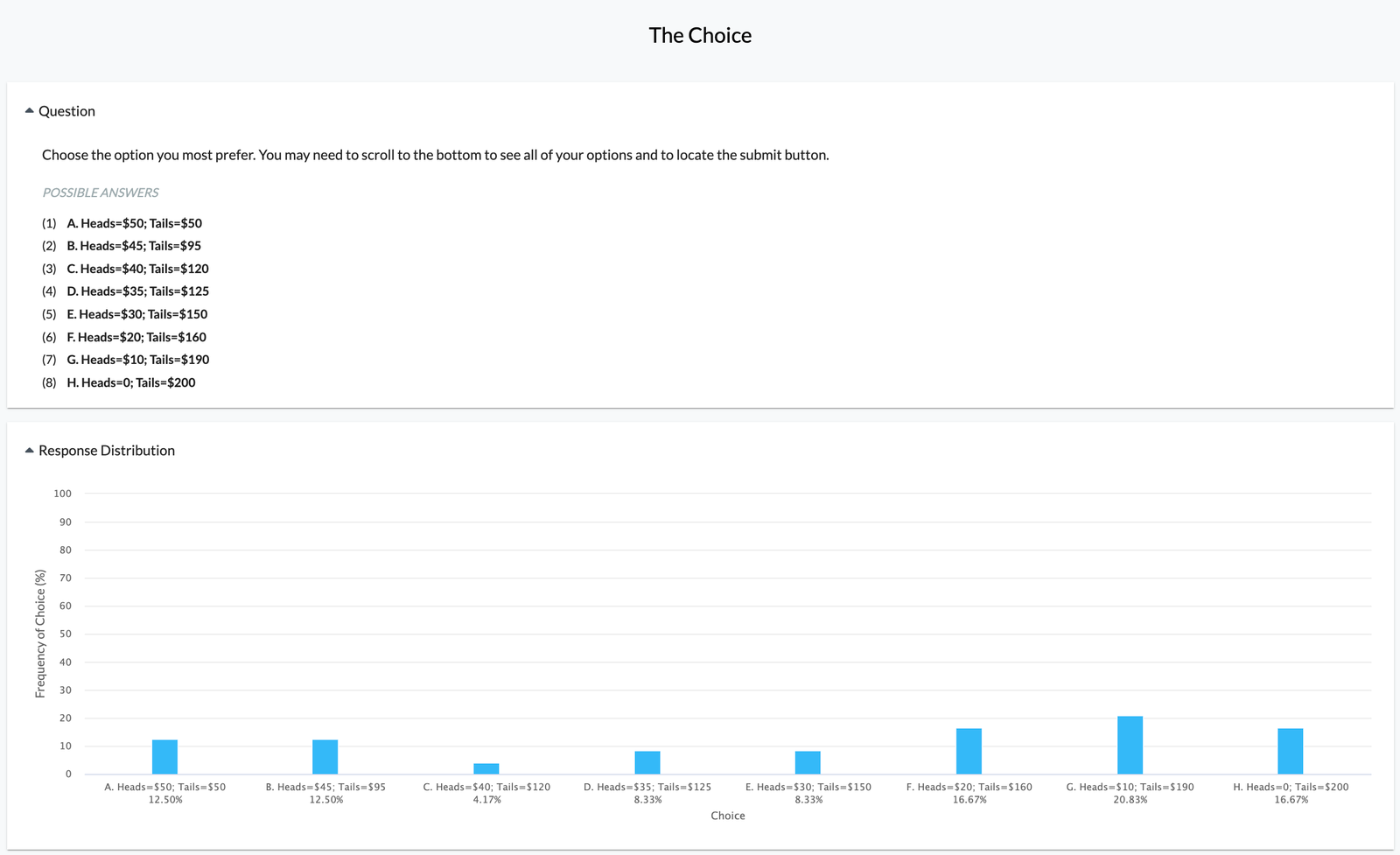

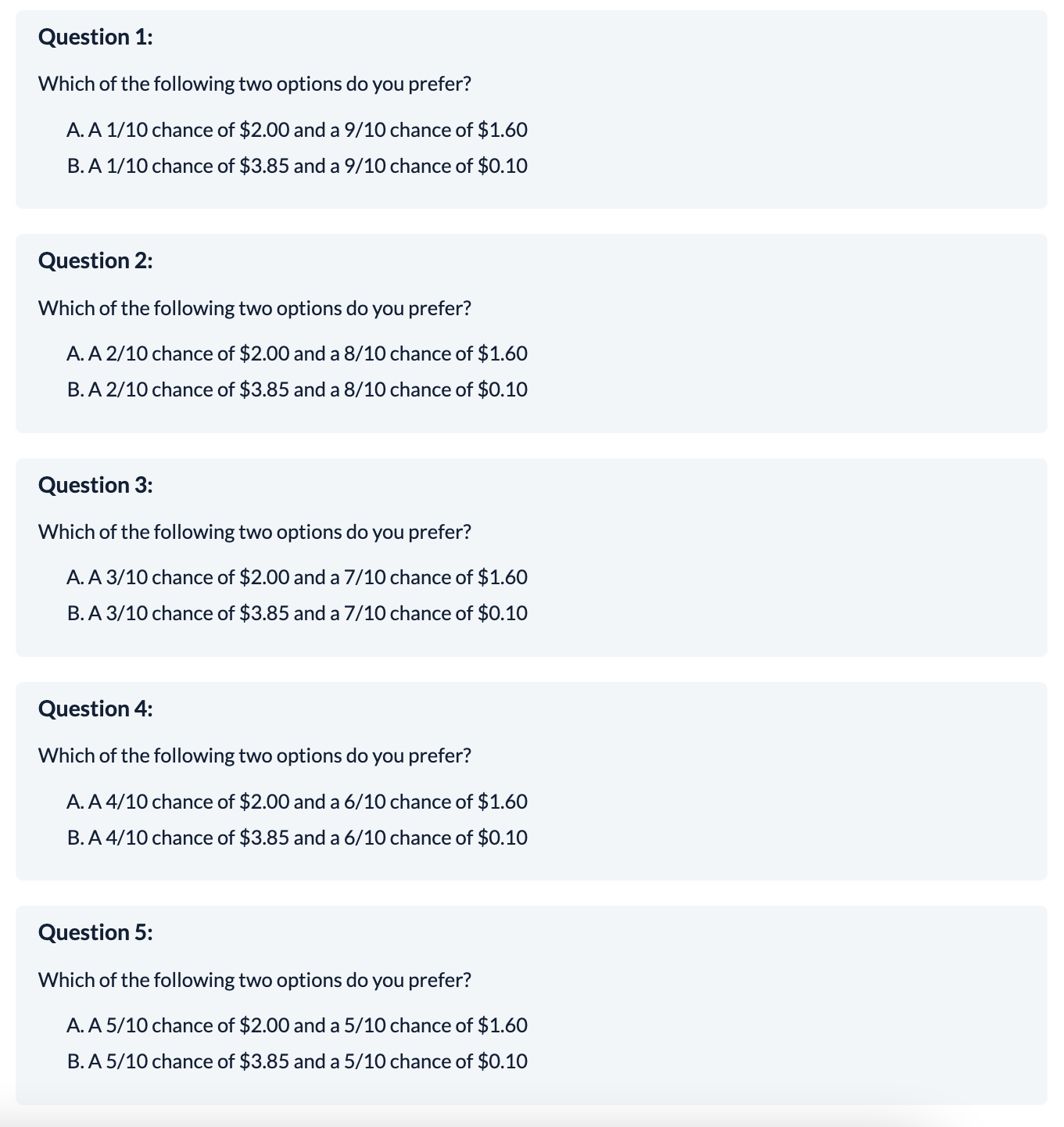

This risk preference survey, based on a design by Holt and Laury in 2002, also measures a student's level of risk aversion when faced with the choice between high and low payoffs; this time the questions are a set of choices between two lotteries. Students face a choice between a "good" outcome that happens with probability P and a "bad" outcome with probability 1 - P. With each choice from Decision 1 to Decision 10, students choose between a safer or riskier lottery, with the riskier lottery offering a larger payoff difference between the good and bad outcomes. The only thing that varies across the choices is the likelihood of each outcome, P.

The choices are:

The first decision where students switch from Lottery A (the safer option) to Lottery B (the riskier option) is a measure of the student’s risk preferences, which will vary on an individual level. As the likelihood of the good outcome increases from Decision 1 to Decision 10, the proportion of students choosing Lottery B should increase as students move through the decision options with Decision 6 or 7 seeing Lottery B become the modal choice. The student who loves risk will start with Lottery B at Decision 1 and the risk neutral student will switch to Lottery B at Decision 5. If risk preferences are stable, students should not switch back to Lottery A once they have switched to Lottery B.

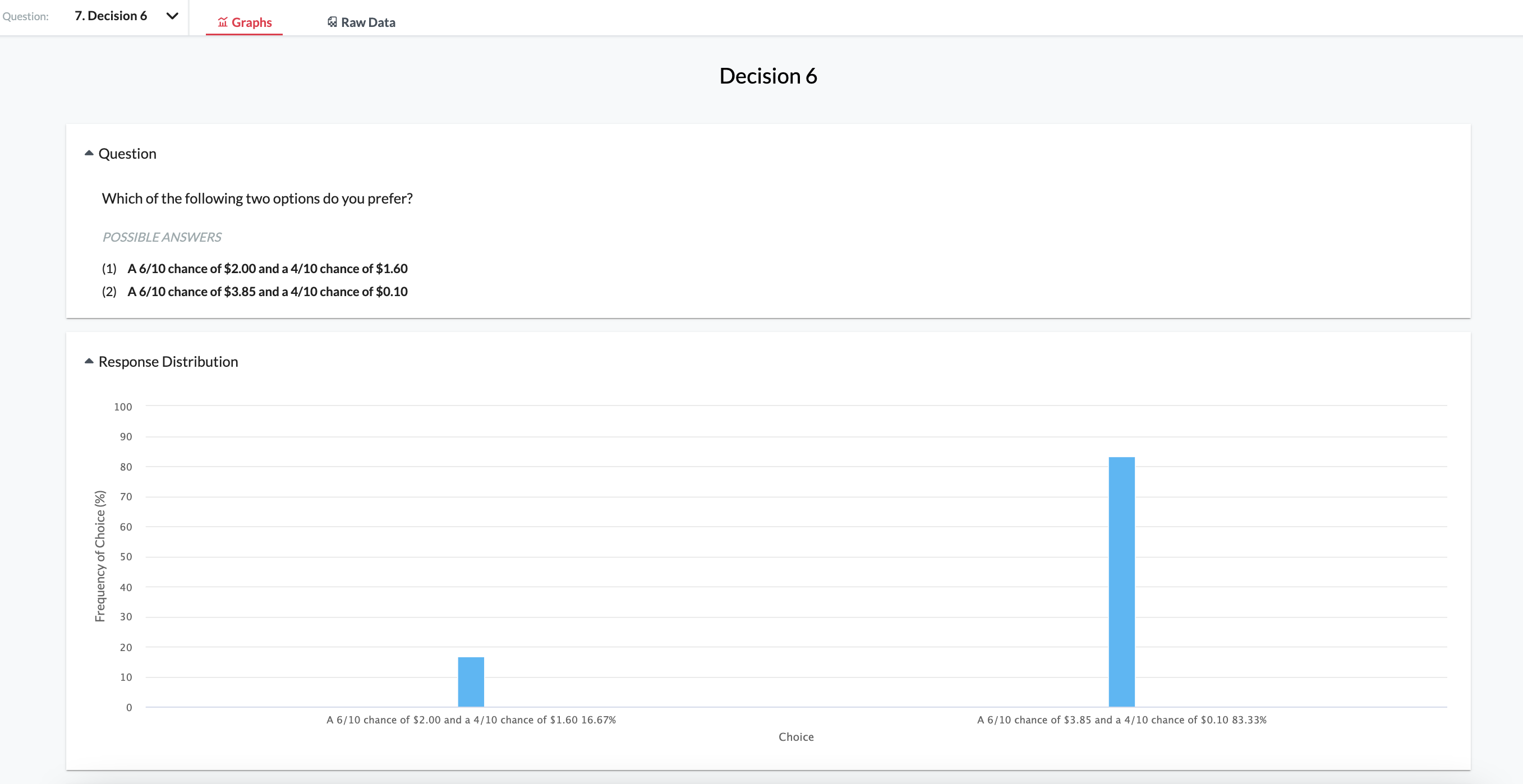

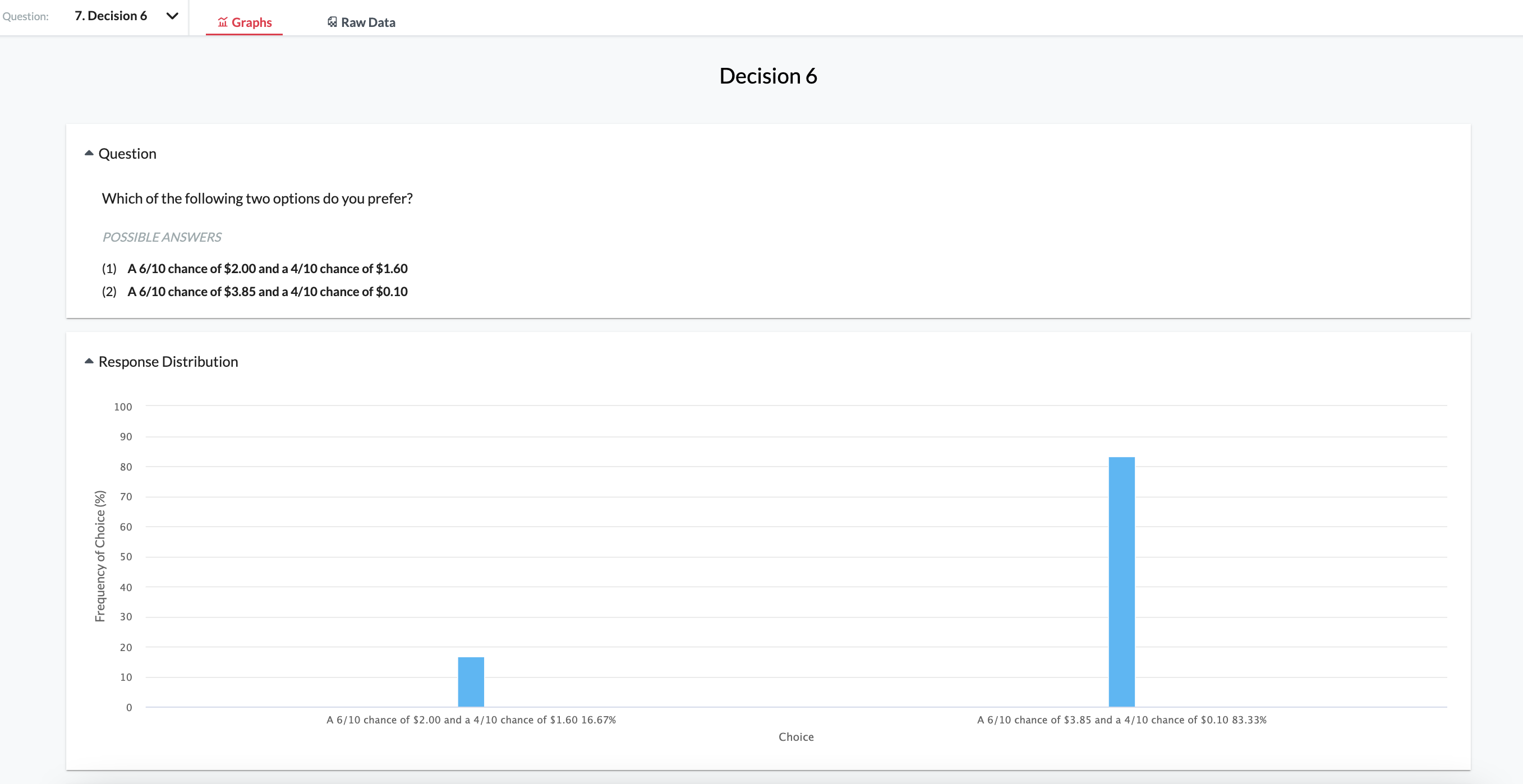

Here is what the survey results may look like for those decisions at 60% chance of a good outcome:

Use the results to depict the distribution of choices by students. In the case of the Holt Laury survey, at what point did students change from Lottery A to Lottery B?

Incorporating pre-made surveys with MobLab online economics games is a great way to teach complicated topics in a simple manner. These pre-made surveys also pair great with our risk preferences games, like the aforementioned Bomb-Risk, Insurance Market, and/or Asset Market games. By playing these games, students can explore how risk preferences factor into real world concepts such as bubble formations and the death spiral. We recommend introducing risk preferences with the pre-made surveys before playing the game, but however you choose to pair them, your students will really think about their own risk sensitivity and what incentivizes them to change their level of risk aversion in their decision-making.

To learn more about MobLab’s surveys, economics games and learning platform, get in touch with our team to schedule a one-on-one demo meeting. With just a few clicks, you can use MobLab's surveys and games in-class or asynchronously. Whether you’re teaching in person, online, or both, MobLab has got your class covered with many different exciting games to choose from.

These simple, yet powerful, surveys can help students easily understand what can often be a complicated subject. Even better, these surveys can be used in live teaching environments or asynchronously.

Let’s dive into a couple of these pre-made risk preferences surveys to see what they’re all about and how they can be used with your class.

Risk Preferences: Binswanger/Eckel and Grossman

Inspired by Binswanger (1980), this pre-made survey measures students’ levels of risk aversion by asking them to choose one of eight payoff options in a fair coin toss. The first option contains no risk. The subsequent choices increase in riskiness and expected value.

Choosing from MobLab's Binswanger Survey Options

Using the results from the survey saves you lecture time, and gives students a graphical breakdown of the class’s choices.

This risk preference survey, based on a design by Holt and Laury in 2002, also measures a student's level of risk aversion when faced with the choice between high and low payoffs; this time the questions are a set of choices between two lotteries. Students face a choice between a "good" outcome that happens with probability P and a "bad" outcome with probability 1 - P. With each choice from Decision 1 to Decision 10, students choose between a safer or riskier lottery, with the riskier lottery offering a larger payoff difference between the good and bad outcomes. The only thing that varies across the choices is the likelihood of each outcome, P.

The choices are:

Choosing from MobLab's Holt Laury Survey Question Sets

The first decision where students switch from Lottery A (the safer option) to Lottery B (the riskier option) is a measure of the student’s risk preferences, which will vary on an individual level. As the likelihood of the good outcome increases from Decision 1 to Decision 10, the proportion of students choosing Lottery B should increase as students move through the decision options with Decision 6 or 7 seeing Lottery B become the modal choice. The student who loves risk will start with Lottery B at Decision 1 and the risk neutral student will switch to Lottery B at Decision 5. If risk preferences are stable, students should not switch back to Lottery A once they have switched to Lottery B.

Here is what the survey results may look like for those decisions at 60% chance of a good outcome:

Use the results to depict the distribution of choices by students. In the case of the Holt Laury survey, at what point did students change from Lottery A to Lottery B?

To learn more about MobLab’s surveys, economics games and learning platform, get in touch with our team to schedule a one-on-one demo meeting. With just a few clicks, you can use MobLab's surveys and games in-class or asynchronously. Whether you’re teaching in person, online, or both, MobLab has got your class covered with many different exciting games to choose from.