As every microeconomics student knows, externalities arise when a person engages in an activity that affects the wealth or well-being of a third who neither pays nor receives any compensation for that effect. This invisible hand, which is usually a great way to organize economic activity, fails to make markets converge to an optimal equilibrium. Aside from identifying the problem and quantifying the deadweight loss to society, microeconomics also offers two elegant solutions: the Pigouvian Tax and a cap and trade approach aka a permit market.

MobLab's Externalities with Policy Intervention Game brings the problem and the solution to life in your lecture. In the game, your students engage as buyers and seller in a standard double auction market. The good they trade is a high-tech Robot Dog. By your configuration, each dog sold either emits a negative externality in the form of barking or a positive externality by increasing the safety of the neighborhood.

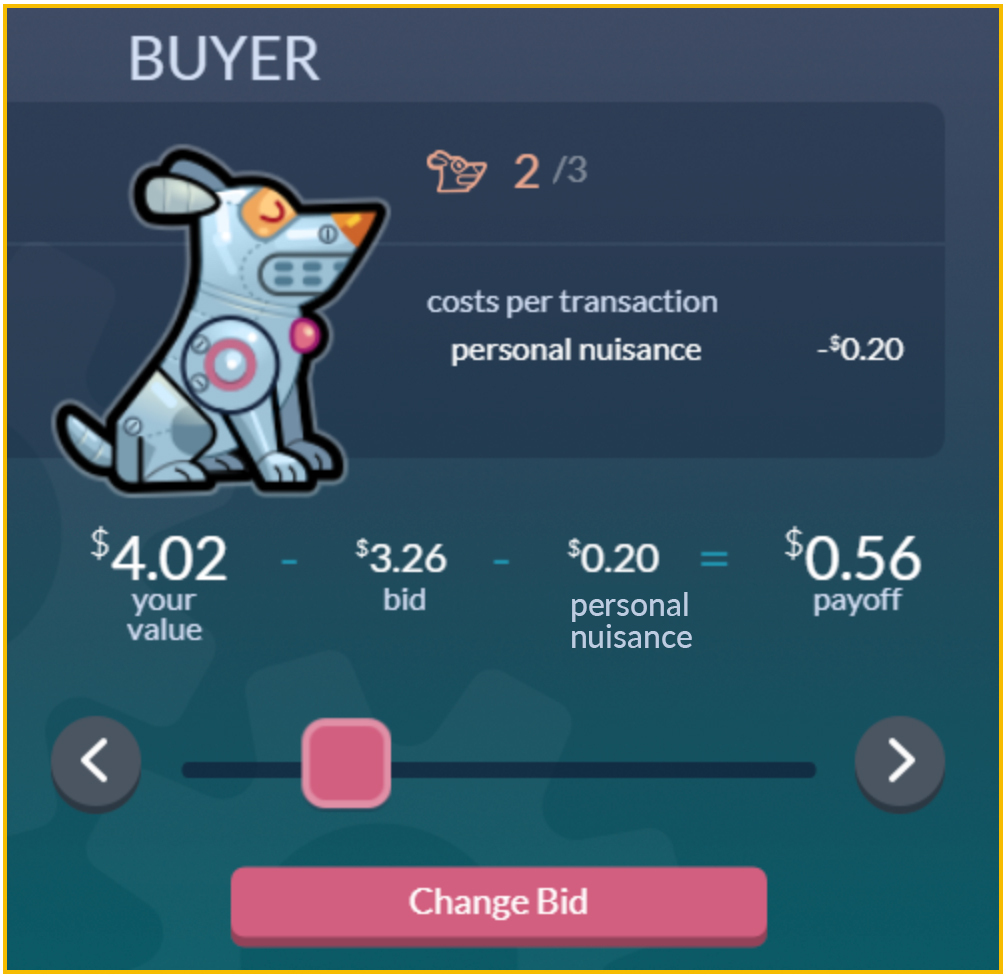

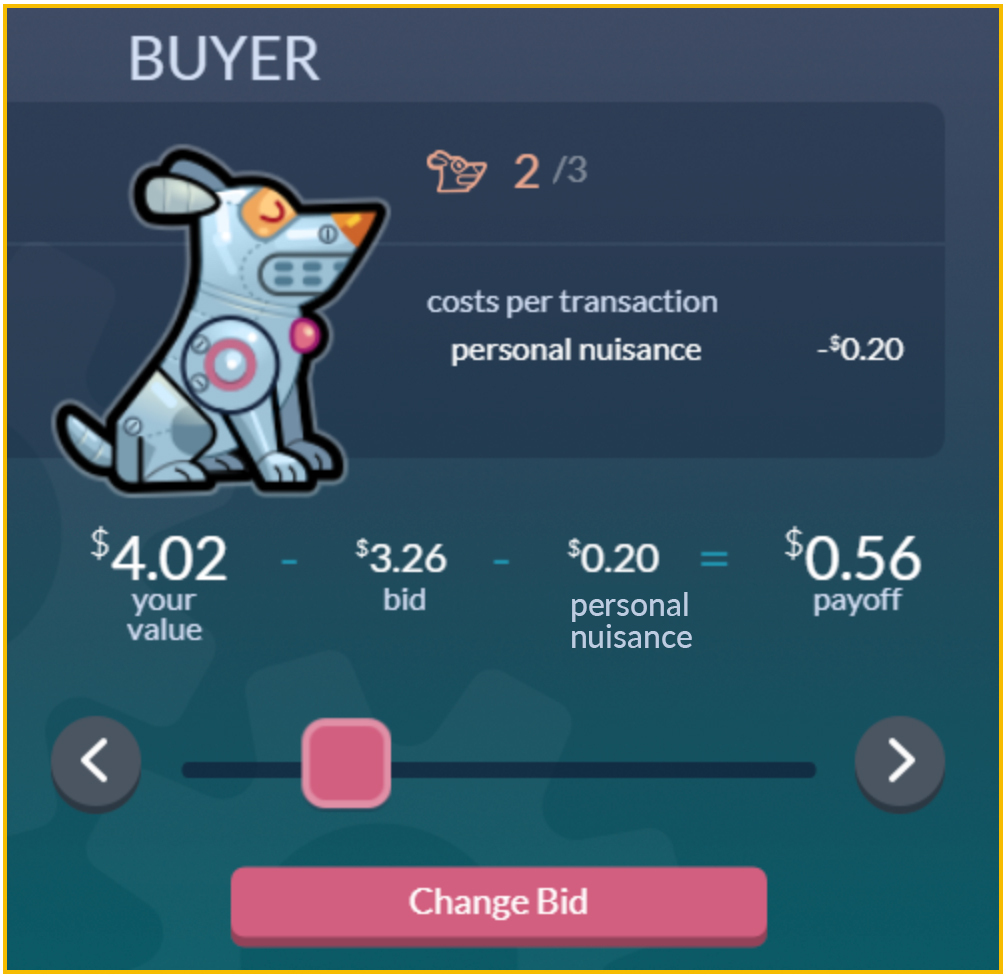

Buyer Screen

Game Results of Negative Externalities + Tax

Obviously, in our perfect experimental world, the surplus that the government raised from the tax is equally distributed among all market participants without any frictions or whatsoever.

Further Treatments

As mentioned earlier, you also have the option to add a treatment with a positive externality or, instead of using a Pigouvian tax, use a cap and trade approach to correct the market failure.

Regardless how your market fails, the experiment will be a guaranteed pedagogical success!

Want to see how your students handle markets that fail? Get in touch with our team! We are eager to set up our economics games for your class!

MobLab's Externalities with Policy Intervention Game brings the problem and the solution to life in your lecture. In the game, your students engage as buyers and seller in a standard double auction market. The good they trade is a high-tech Robot Dog. By your configuration, each dog sold either emits a negative externality in the form of barking or a positive externality by increasing the safety of the neighborhood.

Buyer Screen

Let Your Market Fail…

Simply follow the playlist of our pre-configured module to enhance your micro lecture. The expected running time is 40 min. You may also schedule the playlist as an asynchronous homework assignment.

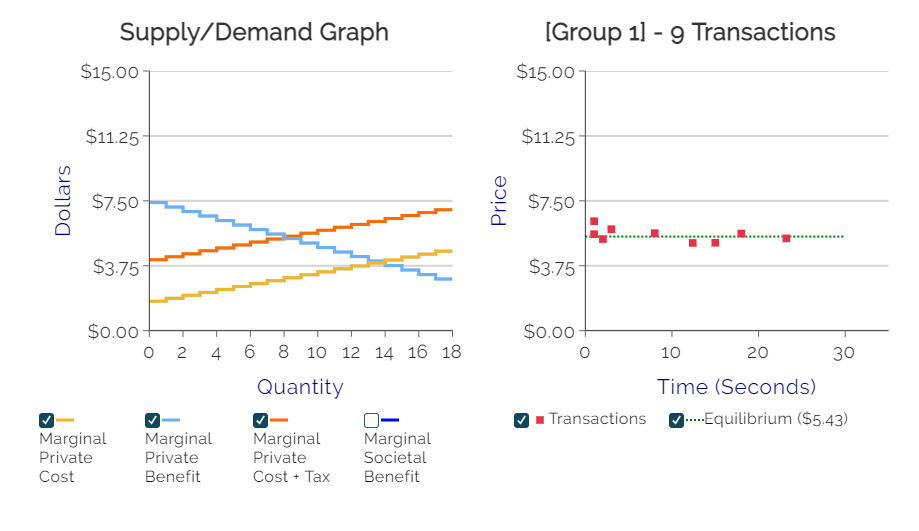

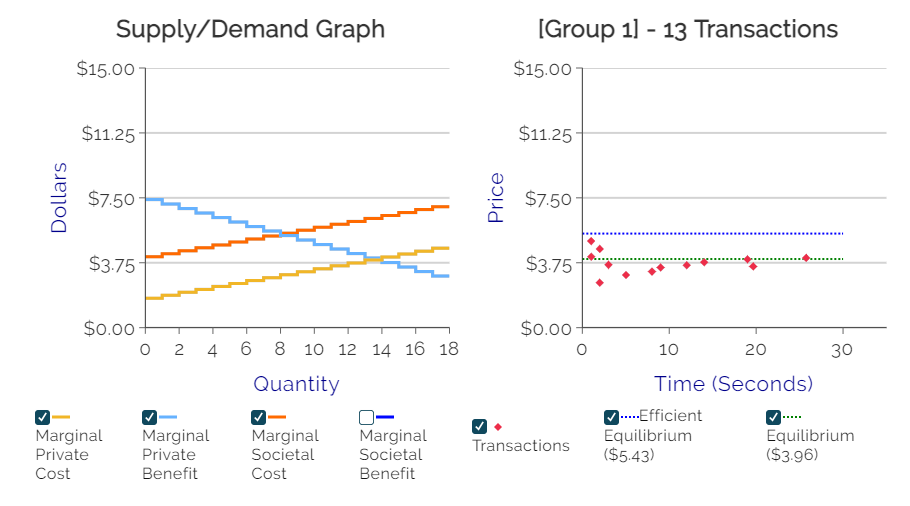

The results below illustrate how the market converged to the equilibrium where the buyers’ private marginal benefits (blue curve) equal the sellers’ private marginal costs (yellow curve). The so-called social cost (red curve) takes the external cost each dog sold imposed on society into account.

Game Results of Negative Externalities Treatment

Correct the Market

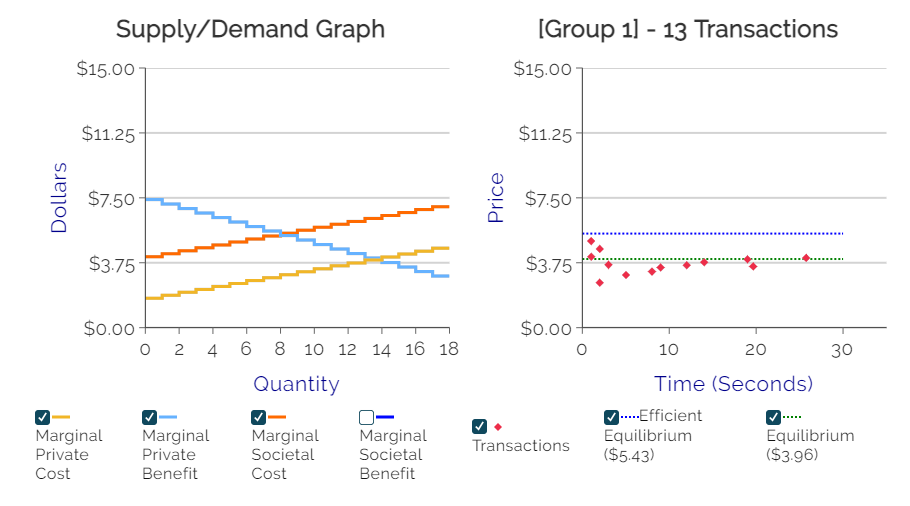

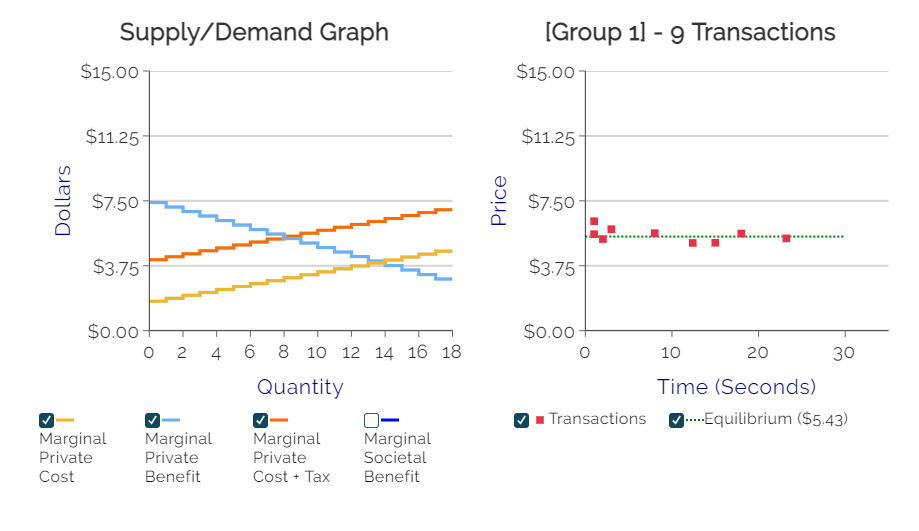

Public policy is rarely as straightforward as in an isolated experimental environment. Following microeconomic theory you may impose a corrective tax on each unit sold to correct the market failure. This tax incentivizes the sellers to accept no price smaller than the social cost. You can now present the outcome of both treatments to your students and explain how the tax made them converge to the price and quantity optimal for society (intersection of red and blue curve).

Simply follow the playlist of our pre-configured module to enhance your micro lecture. The expected running time is 40 min. You may also schedule the playlist as an asynchronous homework assignment.

The results below illustrate how the market converged to the equilibrium where the buyers’ private marginal benefits (blue curve) equal the sellers’ private marginal costs (yellow curve). The so-called social cost (red curve) takes the external cost each dog sold imposed on society into account.

Game Results of Negative Externalities Treatment

Public policy is rarely as straightforward as in an isolated experimental environment. Following microeconomic theory you may impose a corrective tax on each unit sold to correct the market failure. This tax incentivizes the sellers to accept no price smaller than the social cost. You can now present the outcome of both treatments to your students and explain how the tax made them converge to the price and quantity optimal for society (intersection of red and blue curve).

Game Results of Negative Externalities + Tax

Further Treatments

As mentioned earlier, you also have the option to add a treatment with a positive externality or, instead of using a Pigouvian tax, use a cap and trade approach to correct the market failure.

Regardless how your market fails, the experiment will be a guaranteed pedagogical success!

Want to see how your students handle markets that fail? Get in touch with our team! We are eager to set up our economics games for your class!