Welcome to part three of our series on pulling back our curtains at MobLab to give you a peek under the hood. As with our first post on Competitive Market and second post on Push & Pull, our goal here is to share some observations that we have learned from running analytics on our economics games. We continue to be fascinated by the results of live data from our games against economics theories. Today we want to dive deeper into another pair of our most popular strategy games, Ultimatum & Dictator. In particular, we want to measure the effect that the veto right in the Ultimatum game has on the offers presented by the proposer.

Ultimatum & Dictator - Set Up

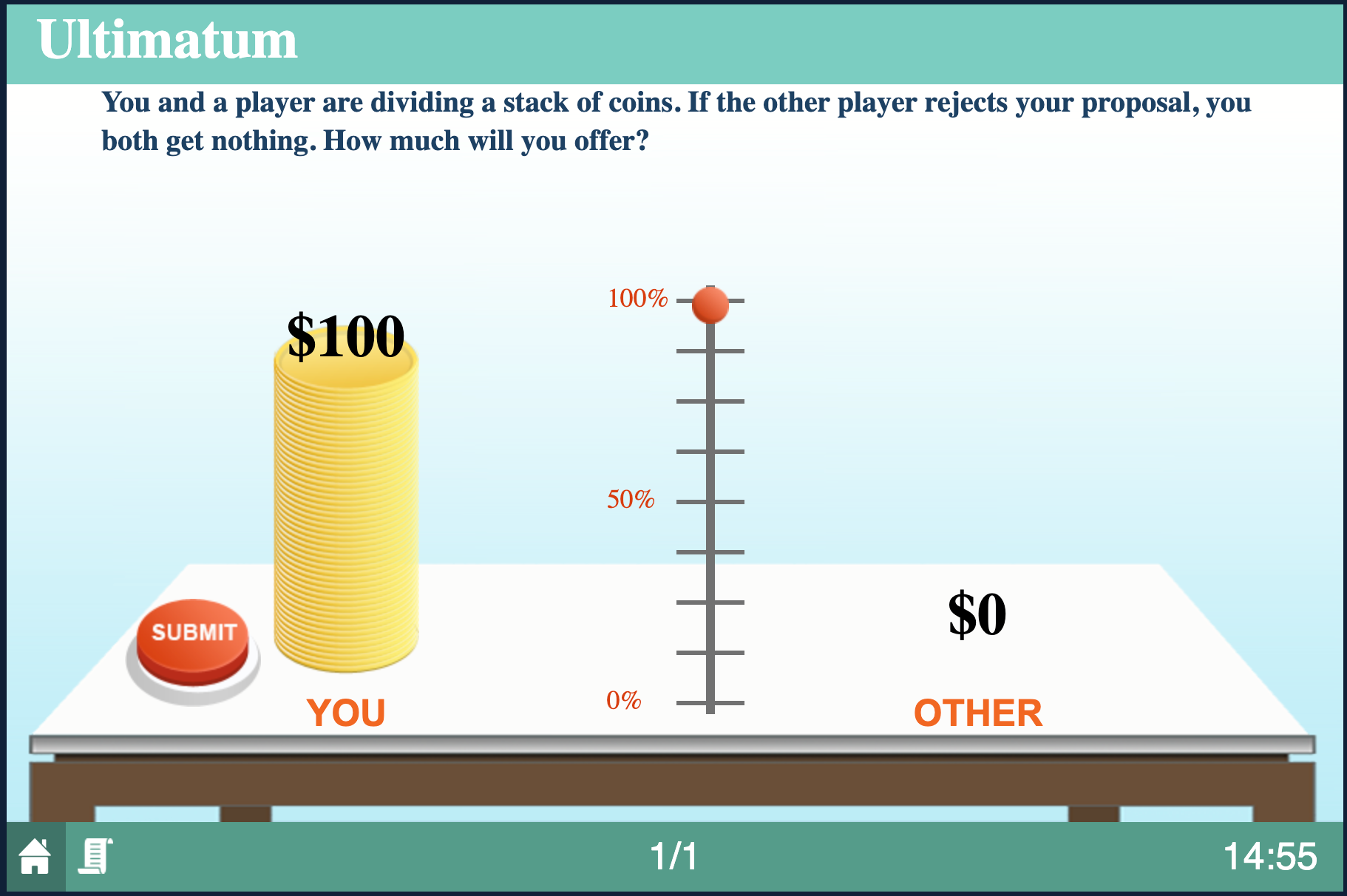

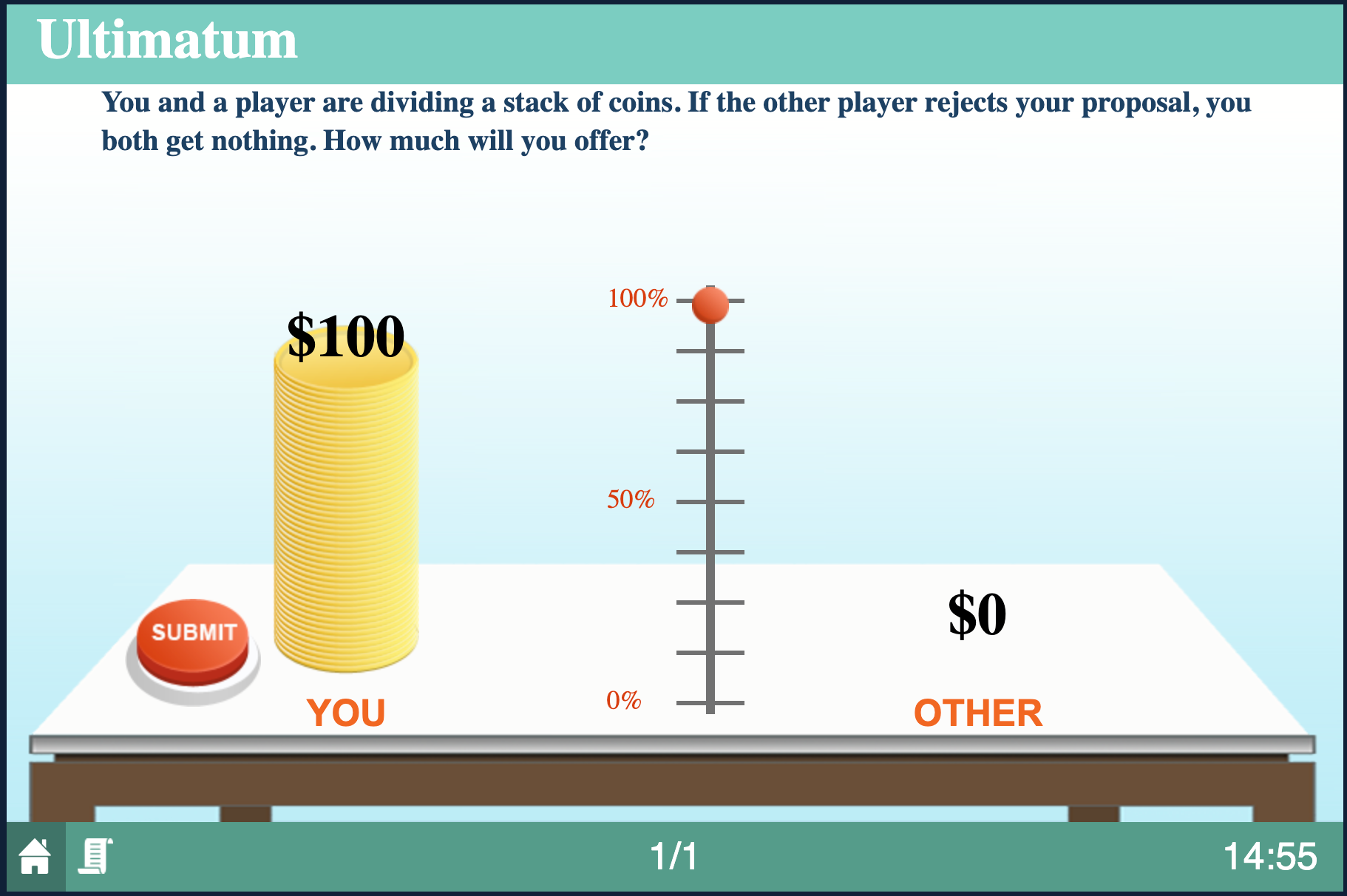

Ultimatum and Dictator can be thought of as one online economics strategy game with two treatments. The basic Ultimatum game was introduced by Güth et al., 1982 and is a two-player game. One player is the proposer, who offers to split a pot of money, $100 in our case, which the other player, the responder, accepts or rejects. If the responder accepts, they receive the respective sums, but if the responder rejects, they both earn 0. This can be thought of as a veto right in many real life bargaining situations, for instance the UN security council.

Game Interface as a Proposer

In the Dictator game, the set up is the same except now, the proposer gets to decide the split and there is no veto right for the responder. The Nash Equilibrium solution to the Ultimatum game would be to offer 1 to make the responder strictly better off than if they had never played. In the Dictator game, the proposer could give 0.

Empirically, this is rarely observed and typically proposers give themselves more than half of the split but still offer a substantial amount to the responder. This is even true in the Dictator game. The question of why this is has been studied manifold and involves cultural norms, psychology, and other contributing factors. Our contribution is to explore this phenomenon across a large scale of observations for its robustness in our game database and so estimate the effect that the veto right (Ultimatum Game) has on the offer made in the First Period of Dictator or Ultimatum.

Ultimatum & Dictator - First Period Offer Visualization

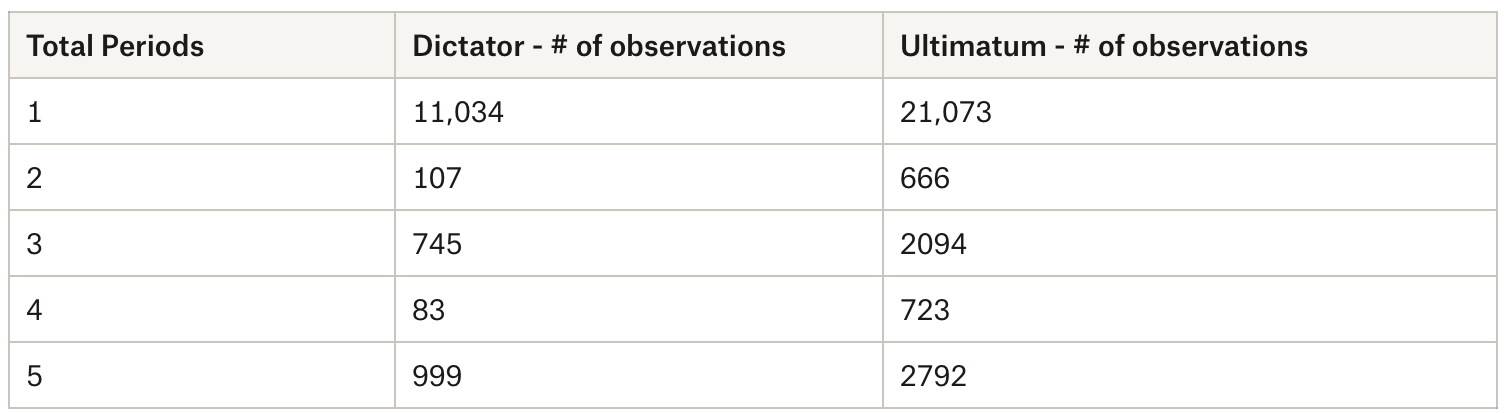

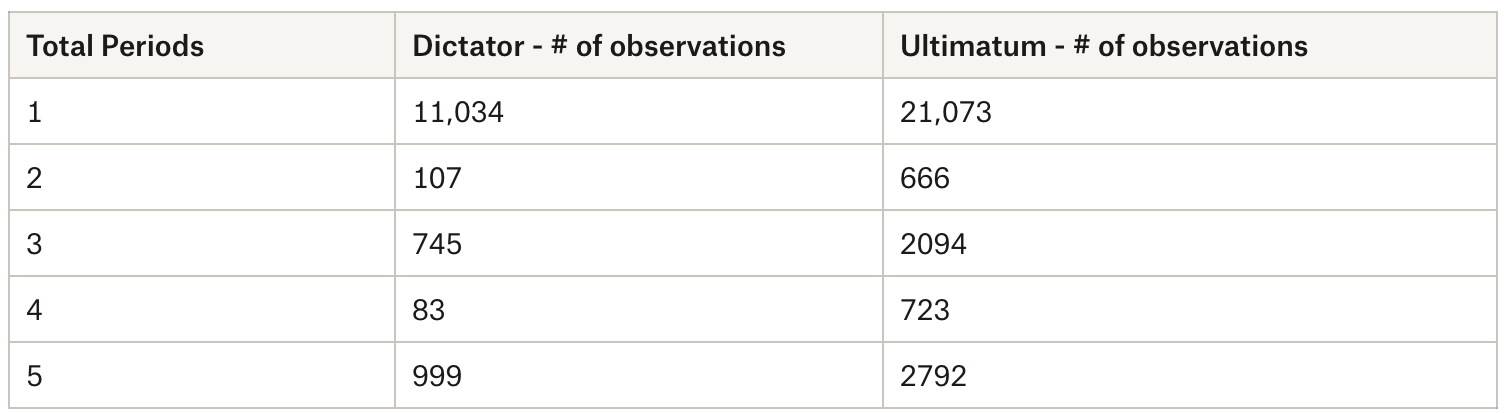

Let’s take a look at our sample size for both games:

Table 1 - Frequency of Ultimatum and Dictator Game

Note the large sample size of over 10,000 observations in our data base for Ultimatum and Dictator games with a total of periods equal to 1. Given our robust sample size, let’s take a look at what the average first offer is by the total periods in game. To clarify, all the observations are from games with a fixed total period number. That is in all games, the participants knew in which round the game would end. Let’s take a first step towards our goal and visualize our data.

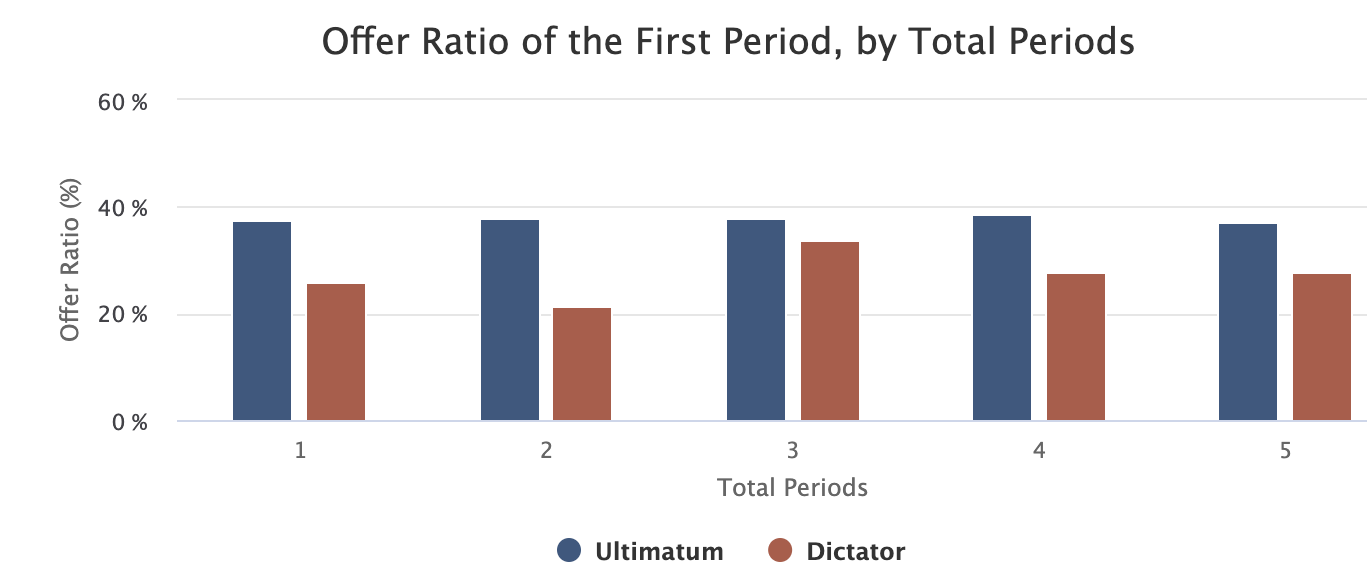

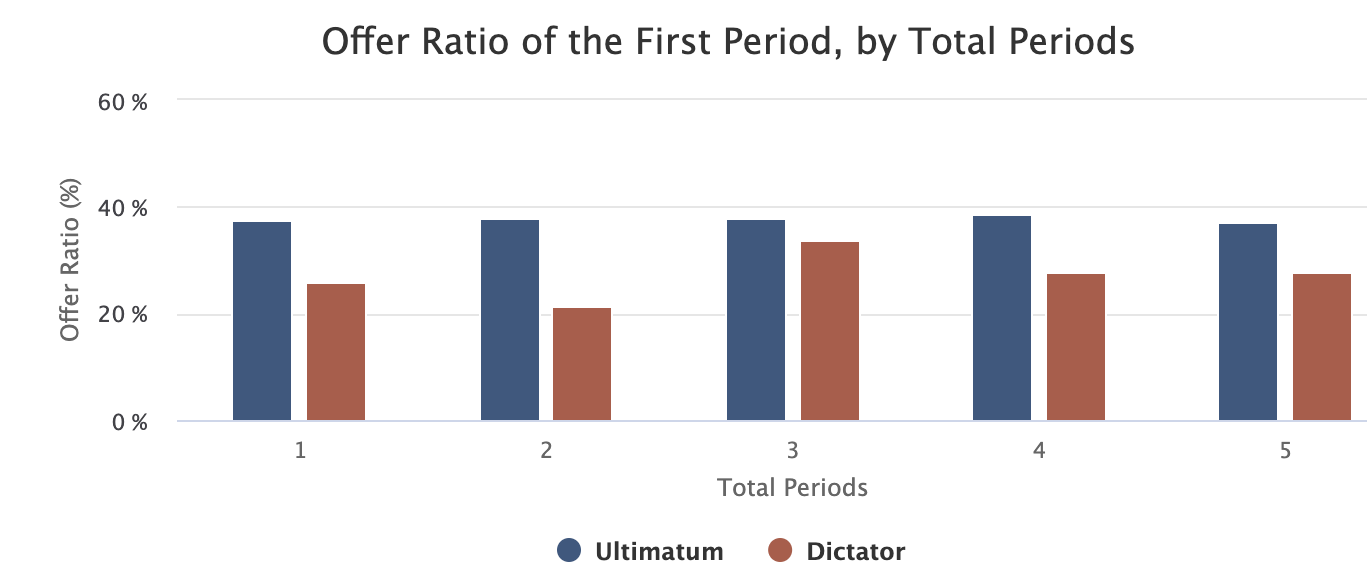

Figure 1 - First Offer Ratio by Total Periods of Game

Looking across all the games of differing total period length, we observe that the first period offer is always larger for the Ultimatum game. This is a relatively intuitive finding that is consistent with the literature. Interestingly though we observe that there seems to be roughly a 10% delta between the Ultimatum first offer and the Dictator first offer. That is, the power of the veto for the responder seems to produce about 10% higher initial offers across all games of differing total period length. It seems to even be independent of the number of total periods.

Regression Analysis

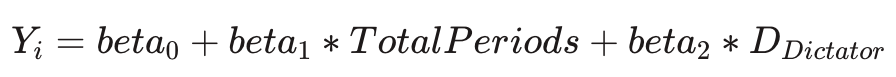

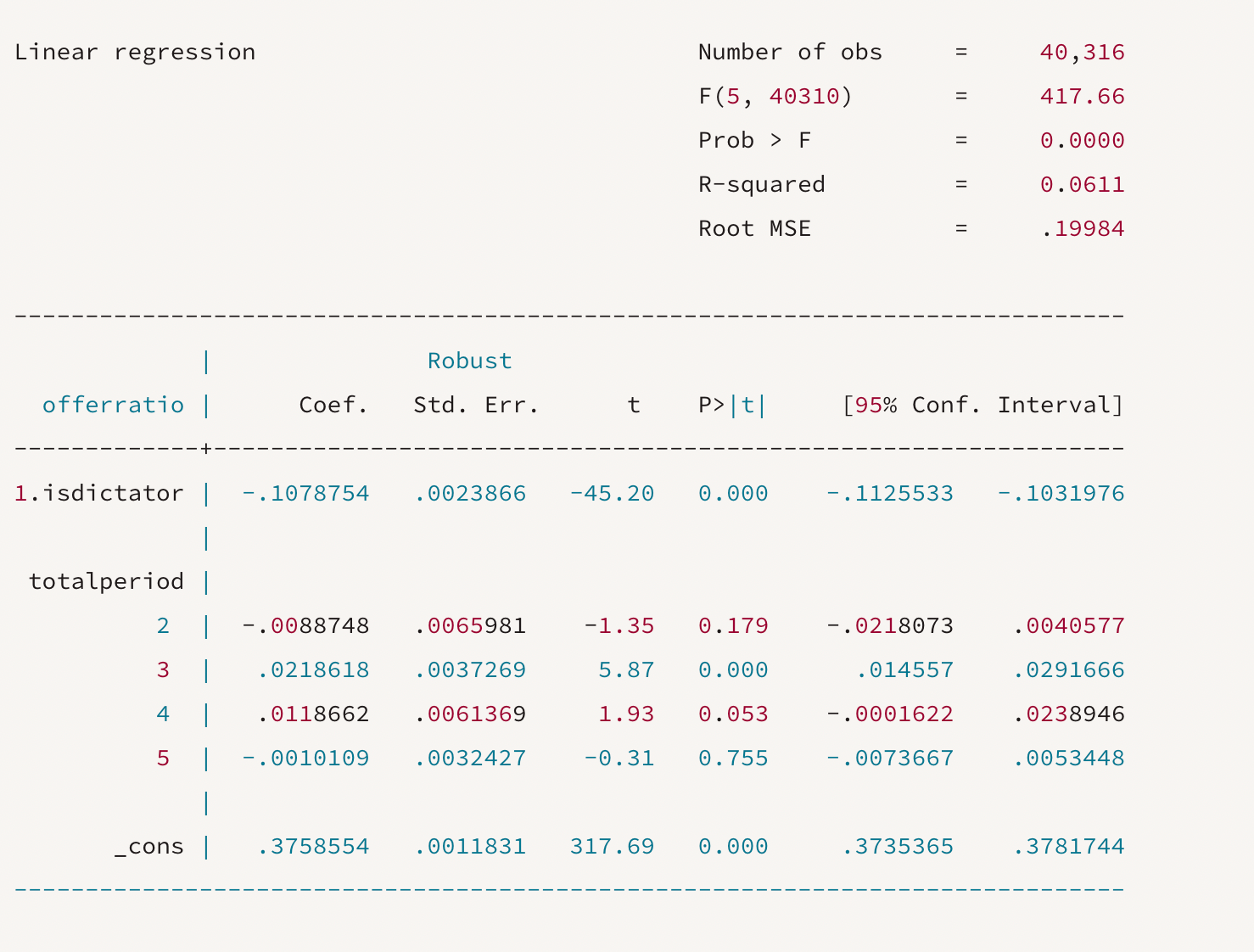

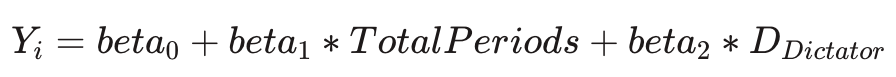

To confirm our visual inference, we run the following regression analysis: where we regress the Offer Ratio in the First Round by the Proposer on the Number of Total Periods in the game and whether it was the Dictator or Ultimatum Game. In particular, we can interpret our beta2 as the power that the veto right has on the offer size.

where we regress the Offer Ratio in the First Round by the Proposer on the Number of Total Periods in the game and whether it was the Dictator or Ultimatum Game. In particular, we can interpret our beta2 as the power that the veto right has on the offer size.

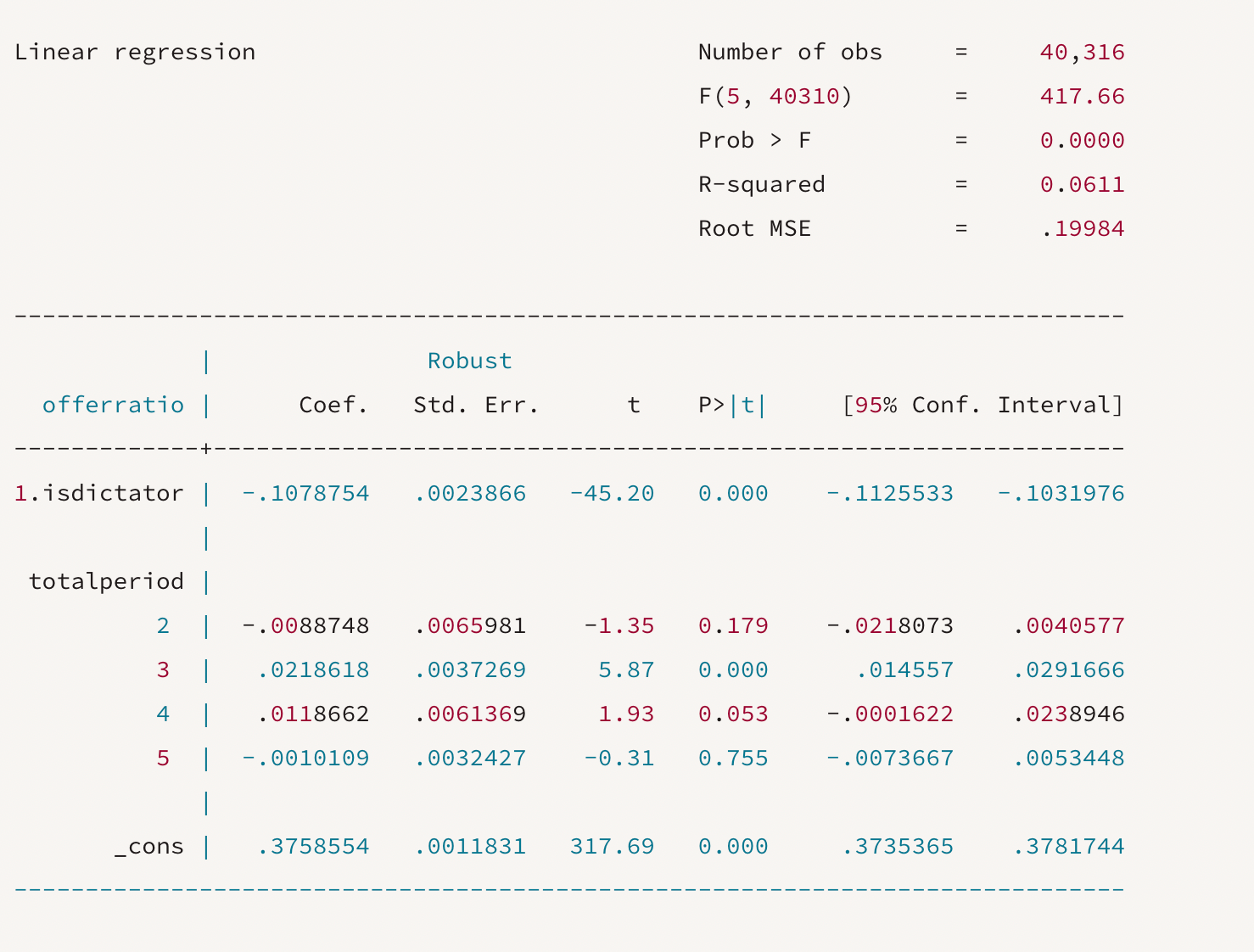

Figure 2 - Linear Regression Model

There are a couple of curious findings here. In our data, when TotalPeriods = 3, the offer is higher by 2%, and this is significant. However, the effect is small, and since our sample sizes are relatively smaller for TotalPeriods = 3 (See Table 1 above), we don’t investigate this further. The second and our key finding is that the effect size of DDictator = 1 is -10.7% with a small standard error of 0.2%. Our visual intuition is confirmed and our large data set evidences that on average the initial offer in an ultimatum game is 10% higher than in a dictator game. We can interpret this as the power of the veto right in bargaining. Interestingly, this result is largely unaffected by the total number of periods the game will last. It is possible that this might be changed by an indefinite repetition of the game? We leave that question for another blog post!

Conclusion

Our large data set confirms the basic intuitions of previous findings for the Ultimatum and Dictator games. Students offer substantially more than the Nash Equilibrium prediction. In the Ultimatum game they offer more than in the Dictator game suggesting that the veto power has a measurable effect on the offer proposers make. Our contribution is to estimate this effect size across a large sample of student observations. We find that the veto right of the Ultimatum game produces roughly a 10% increase in the average first offer.

This concludes our series on large-scale analysis of our experimental data. You can read up on our work on Competitive Market and on Push & Pull, or stay tuned for further posts coming up.

Want to see if your students will conform to these data outcome? Get in touch with our team! We are eager to set up our economics games for your class!

Ultimatum & Dictator - Set Up

Ultimatum and Dictator can be thought of as one online economics strategy game with two treatments. The basic Ultimatum game was introduced by Güth et al., 1982 and is a two-player game. One player is the proposer, who offers to split a pot of money, $100 in our case, which the other player, the responder, accepts or rejects. If the responder accepts, they receive the respective sums, but if the responder rejects, they both earn 0. This can be thought of as a veto right in many real life bargaining situations, for instance the UN security council.

Game Interface as a Proposer

Empirically, this is rarely observed and typically proposers give themselves more than half of the split but still offer a substantial amount to the responder. This is even true in the Dictator game. The question of why this is has been studied manifold and involves cultural norms, psychology, and other contributing factors. Our contribution is to explore this phenomenon across a large scale of observations for its robustness in our game database and so estimate the effect that the veto right (Ultimatum Game) has on the offer made in the First Period of Dictator or Ultimatum.

Ultimatum & Dictator - First Period Offer Visualization

Let’s take a look at our sample size for both games:

Table 1 - Frequency of Ultimatum and Dictator Game

Figure 1 - First Offer Ratio by Total Periods of Game

Regression Analysis

To confirm our visual inference, we run the following regression analysis:

Figure 2 - Linear Regression Model

Conclusion

Our large data set confirms the basic intuitions of previous findings for the Ultimatum and Dictator games. Students offer substantially more than the Nash Equilibrium prediction. In the Ultimatum game they offer more than in the Dictator game suggesting that the veto power has a measurable effect on the offer proposers make. Our contribution is to estimate this effect size across a large sample of student observations. We find that the veto right of the Ultimatum game produces roughly a 10% increase in the average first offer.

This concludes our series on large-scale analysis of our experimental data. You can read up on our work on Competitive Market and on Push & Pull, or stay tuned for further posts coming up.

Want to see if your students will conform to these data outcome? Get in touch with our team! We are eager to set up our economics games for your class!