It’s been around now for some years, but cryptocurrency still fascinates people and the markets. If I may include a personal note here, my wife (who is otherwise not deeply interested in finance) holds some currencies herself. It seems that bitcoin and its kind are the (not so) new kids on the block that everybody finds interesting. What is not always clear to unsuspecting investors, is that these financial products can be highly volatile and are far less regulated compared to traditional financial products. This can be especially dangerous for those who do not have high financial liquidity and consequently are sensitive to the downturn that these investments can have. Worse yet, even some borderline illegal activities have been known to occur with various coins as governments around the globe are struggling to set the regulatory framework for these products.

How does this figure in MobLab? We are glad you asked! Odds are that among your students in your economics course, there are going to be some investors in cryptocurrencies. So why not use MobLab for the dual purpose of engaging them with a topic they are already deeply interested in and teaching them a valuable lesson not to be imprudent when it comes to the investment of their savings. How can you connect MobLab and cryptocurrency? Enter our Centipede game.

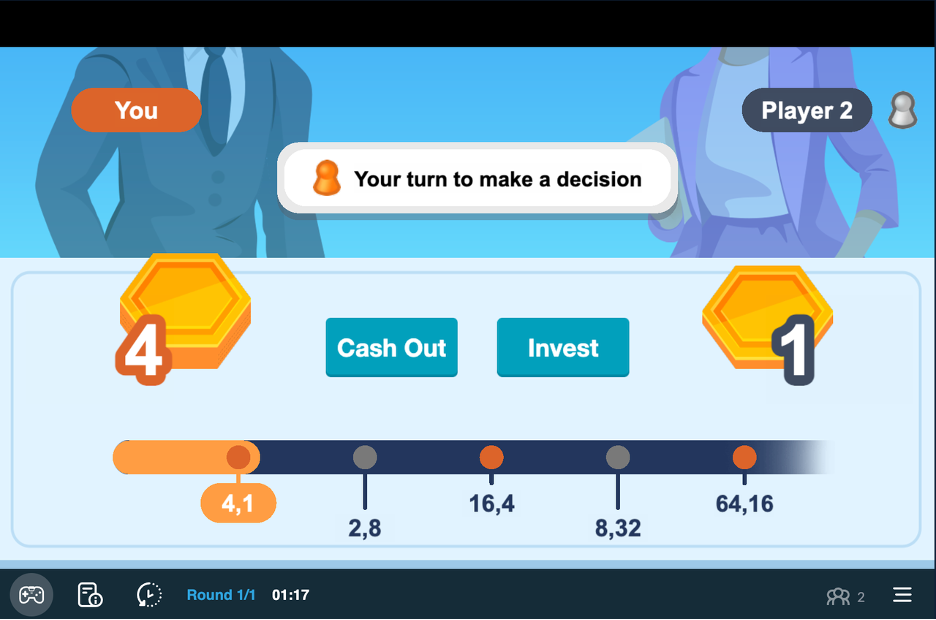

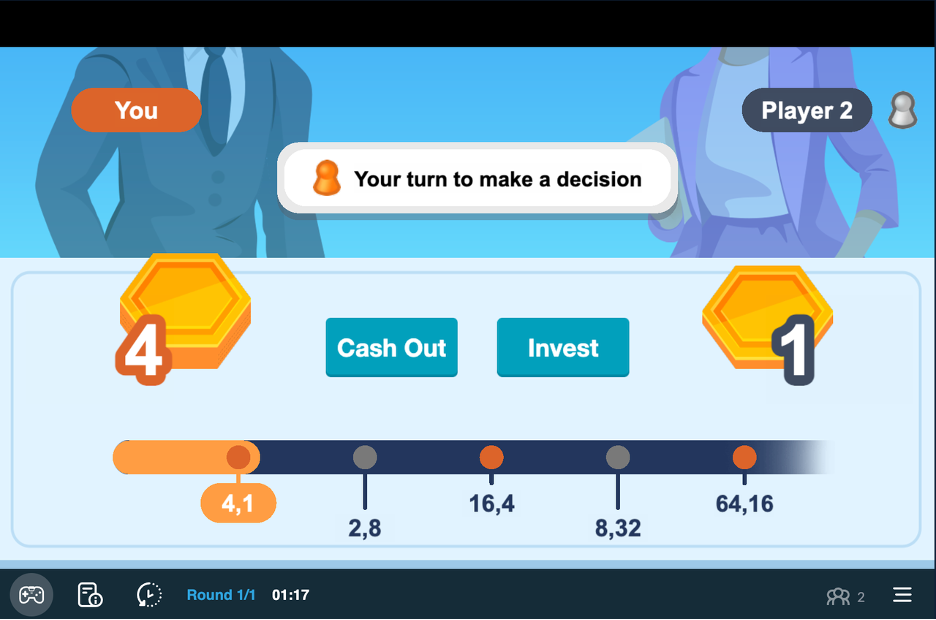

Centipede Game Interface

Our Centipede game is a classic from Game Theory, based on taking turns to decide whether to cash out or invest in a joint business opportunity. In the traditional set up of this game, the Subgame Perfect Nash Equilibrium is for the cash out to appear in the first round. Teaching your students about this game will help them not to trust such a scheme since its outcome is predicted well by theory.

For our cryptocurrency example, you can tell the story of a so called “rug pull” as it is known in cryptocurrency circles. In this scenario, a group sets up a currency and invests some initial money into it while heavily advertising - mostly through social media - to get others to buy. Once the value has gone up, due to investment of the crowd, the owners quickly sell their holding and disappear. You can think of this as a centipede interaction where there is advertising during the turn taking.

This is the algorithm used by the scammers:

Round 0: Investment by owners of the coin

Round 1: Investment by crowd

Round 2: Investors cash out at high value due to investment by crowd

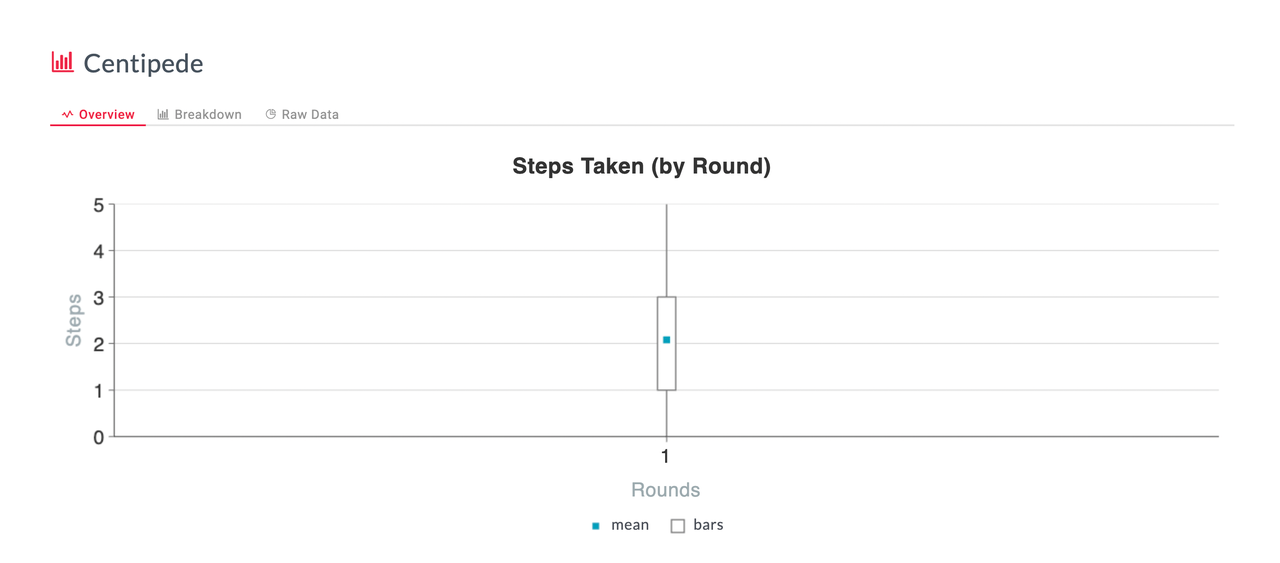

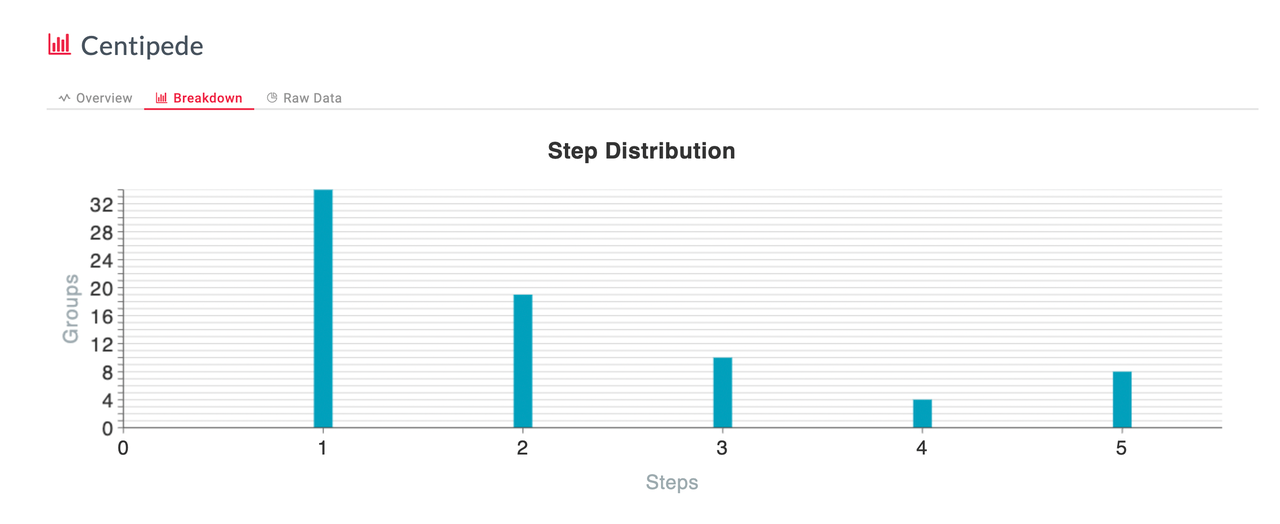

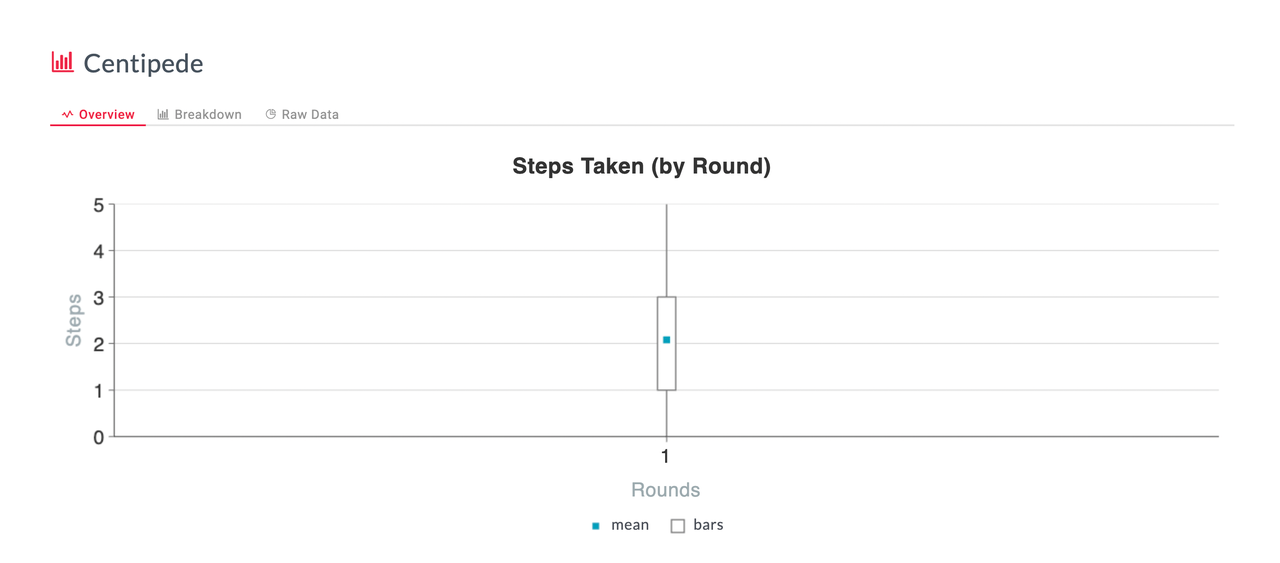

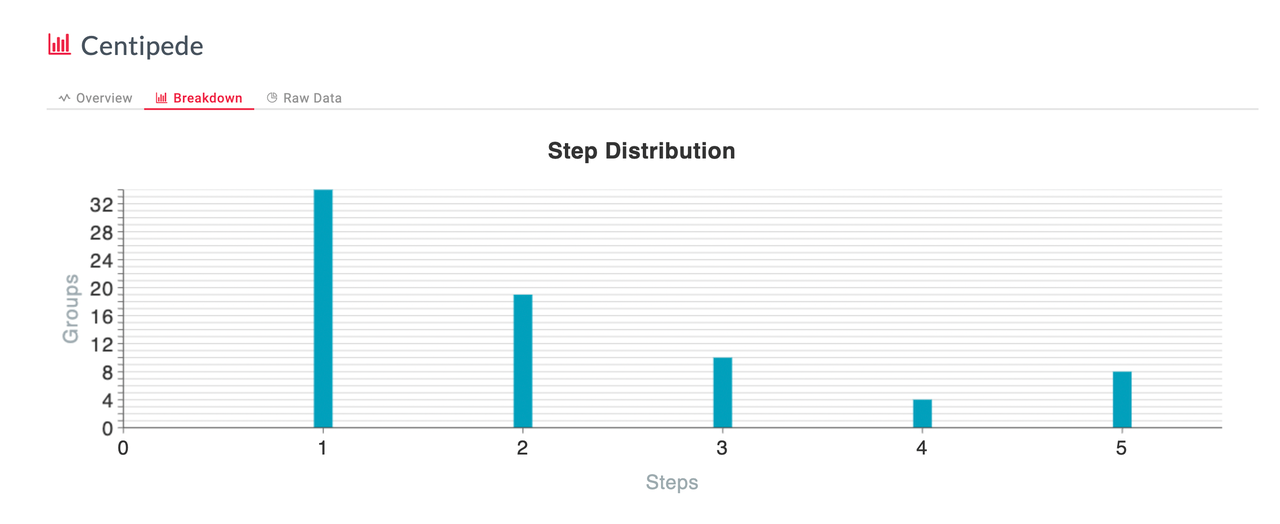

The outcome of the cash out in round 2 is exactly what we would expect since it’s when the cash out is profitable for the owners. Anticipating this, buyers can avoid the trap. To make sure that the idea sticks with your students, we generate results graphs for you after the end of the game that display a box plot for the average number of steps taken across all groups and a frequency distribution by steps.

Box Plot for Steps Taken Distribution of Steps

In these sample results taken from a class, you can observe that the majority students understand the game and cash out in the first round but not all of them. A substantial number reach higher steps and are consequently the ones that might have their rug pulled out from underneath them.

Application

That this is a real-world problem was even recently shown by the “Squid Game” currency “rug pull.” “Rug pull” is known in the crypto space as a scenario “when a development team suddenly abandons a project and sells or removes all its liquidity. The name comes from the phrase to pull the rug out from under (someone), meaning to withdraw support unexpectedly.” (Binance Academy)

In the story of the “Squid Game” token, as described in more detail by the Washington Post, a group of token creators, launched a cryptocurrency named after the Netflix Show “Squid Game,” which according to CoinMarketCap rose from $0.1871 on Oct, 28th to $90.19 on Nov, 1st to drop down to $0.006 on the same day. This happened after the initial investors sold off their shares at high value in the frenzy, created by massive advertising campaigns on social media, which effectively devalued the currency. Those who unfortunately fell into the trap of the investment, learned the predicted outcome of the Centipede game the hard way. However, you can elucidate the dangers of such scenarios and strike at them preemptively with our Centipede game. After all our educational institutions are meant to train our students for success in the world outside of the lecture hall.

To learn more about MobLab economics games, sign up for a free instructor account or get in touch with our team to schedule a one-on-one demo meeting.

How does this figure in MobLab? We are glad you asked! Odds are that among your students in your economics course, there are going to be some investors in cryptocurrencies. So why not use MobLab for the dual purpose of engaging them with a topic they are already deeply interested in and teaching them a valuable lesson not to be imprudent when it comes to the investment of their savings. How can you connect MobLab and cryptocurrency? Enter our Centipede game.

Centipede Game Interface

For our cryptocurrency example, you can tell the story of a so called “rug pull” as it is known in cryptocurrency circles. In this scenario, a group sets up a currency and invests some initial money into it while heavily advertising - mostly through social media - to get others to buy. Once the value has gone up, due to investment of the crowd, the owners quickly sell their holding and disappear. You can think of this as a centipede interaction where there is advertising during the turn taking.

This is the algorithm used by the scammers:

Round 0: Investment by owners of the coin

Round 1: Investment by crowd

Round 2: Investors cash out at high value due to investment by crowd

The outcome of the cash out in round 2 is exactly what we would expect since it’s when the cash out is profitable for the owners. Anticipating this, buyers can avoid the trap. To make sure that the idea sticks with your students, we generate results graphs for you after the end of the game that display a box plot for the average number of steps taken across all groups and a frequency distribution by steps.

Box Plot for Steps Taken Distribution of Steps

In these sample results taken from a class, you can observe that the majority students understand the game and cash out in the first round but not all of them. A substantial number reach higher steps and are consequently the ones that might have their rug pulled out from underneath them.

Application

That this is a real-world problem was even recently shown by the “Squid Game” currency “rug pull.” “Rug pull” is known in the crypto space as a scenario “when a development team suddenly abandons a project and sells or removes all its liquidity. The name comes from the phrase to pull the rug out from under (someone), meaning to withdraw support unexpectedly.” (Binance Academy)

In the story of the “Squid Game” token, as described in more detail by the Washington Post, a group of token creators, launched a cryptocurrency named after the Netflix Show “Squid Game,” which according to CoinMarketCap rose from $0.1871 on Oct, 28th to $90.19 on Nov, 1st to drop down to $0.006 on the same day. This happened after the initial investors sold off their shares at high value in the frenzy, created by massive advertising campaigns on social media, which effectively devalued the currency. Those who unfortunately fell into the trap of the investment, learned the predicted outcome of the Centipede game the hard way. However, you can elucidate the dangers of such scenarios and strike at them preemptively with our Centipede game. After all our educational institutions are meant to train our students for success in the world outside of the lecture hall.

To learn more about MobLab economics games, sign up for a free instructor account or get in touch with our team to schedule a one-on-one demo meeting.