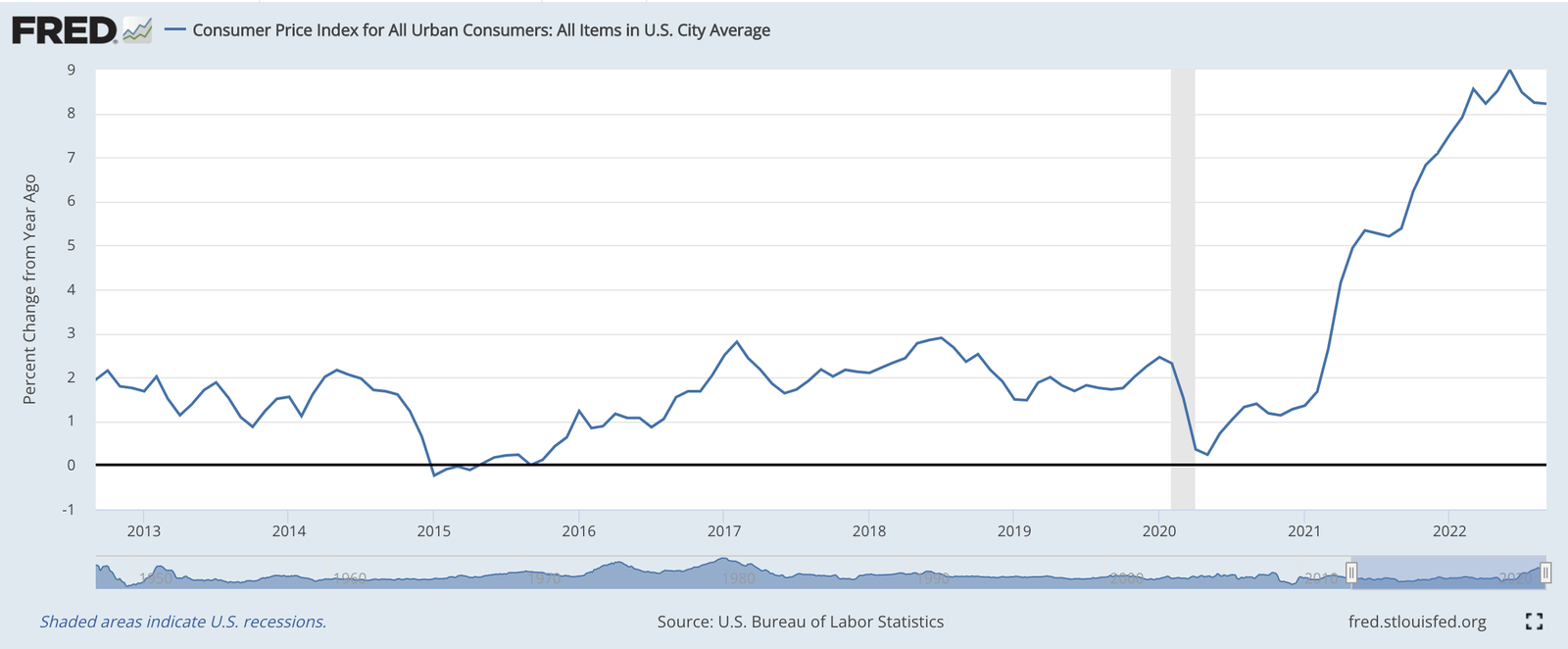

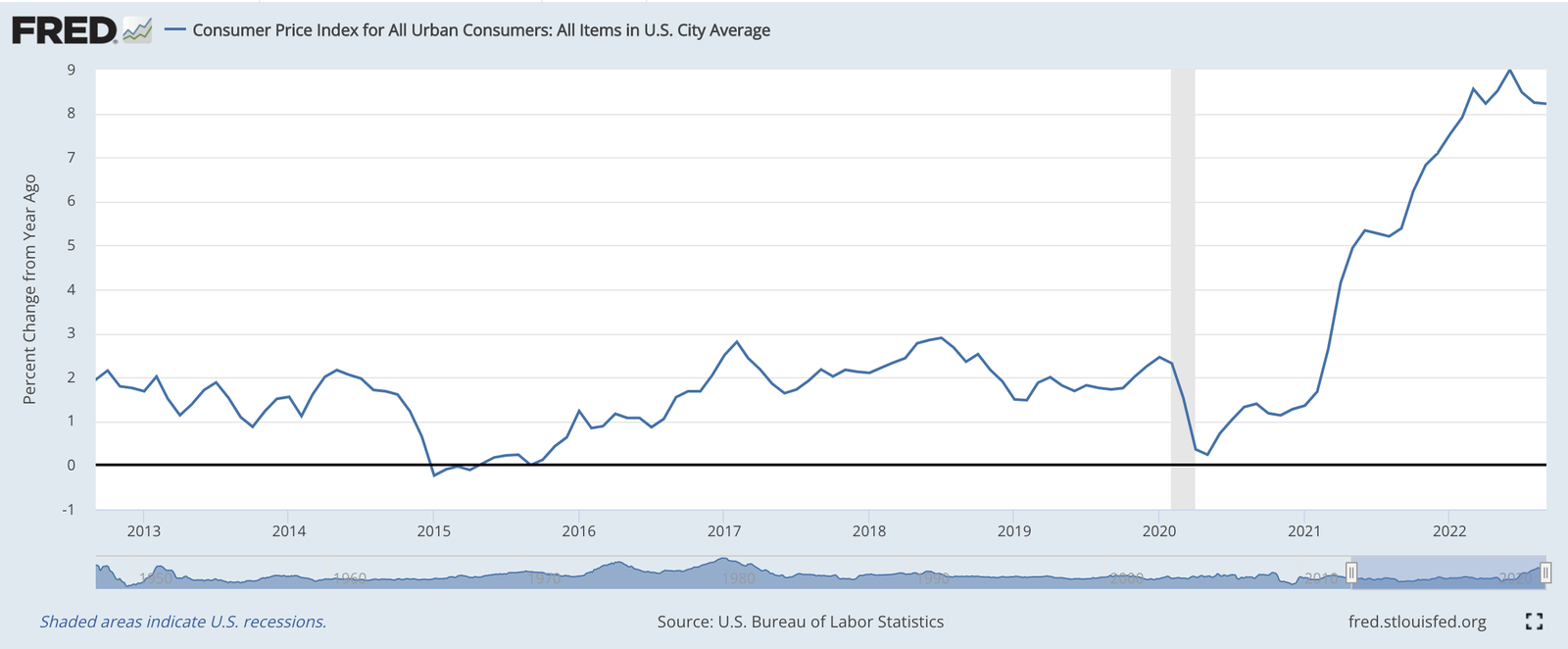

The two macroeconomic concepts of interest rates and inflation are becoming more and more common in the news today. Even while away from their television and phone screens, consumers are experiencing the effects of price increases at places such as the gas pump, grocery store, and medical bills. In general, the world has not experienced such macroeconomic phenomena in over 40 years, and for most economics students in the classroom, this is their first time experiencing these phenomena. How can students better understand what is happening in the macroeconomy?

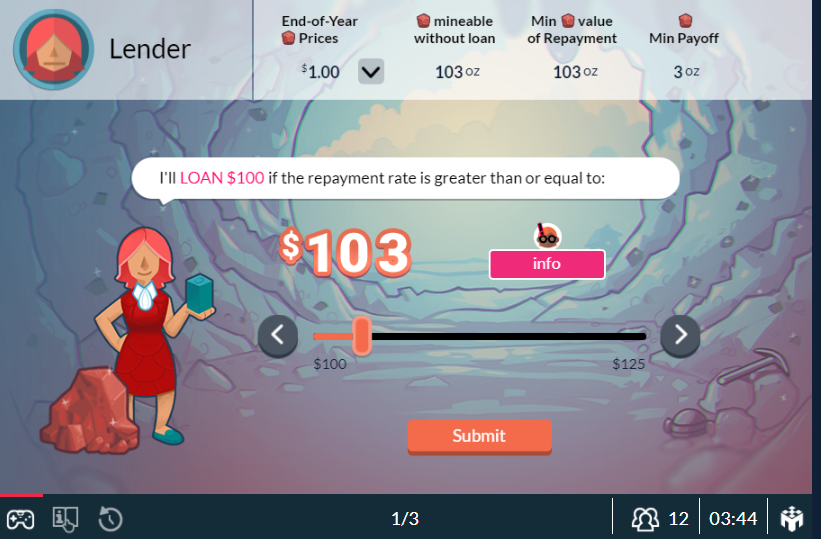

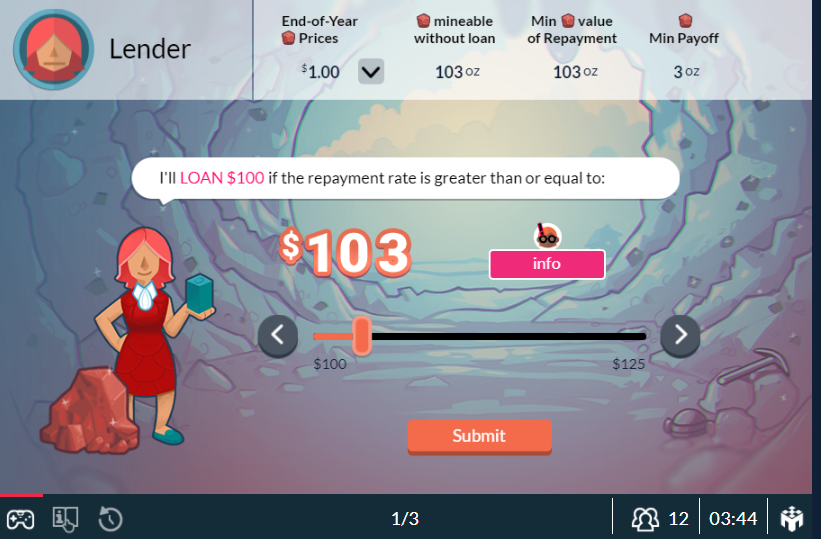

With MobLab’s Interest Rates & Inflation game, students learn first-hand about the dynamics related to macroeconomic borrowing and lending. Each student has a private rate of return on a $100 investment, but only half of each group of students has $100. Equilibrium loan repayment amount is determined by the intersection of the lenders’ minimum acceptable and borrowers’ maximum acceptable repayment amounts. Payoff for a round (year) equals a player’s increase in real wealth.

We previously published an excellent MobLab blog post that summarizes the Interest Rates and Inflation game, but in this post we will focus on how you can apply uncertainty to inflation by setting multiple interest rates. Why use uncertainty? Applying uncertainty by changing a few simple parameters in the Interest Rates and Inflation game is a great way to mirror the macro environment we live in today for students to better relate.

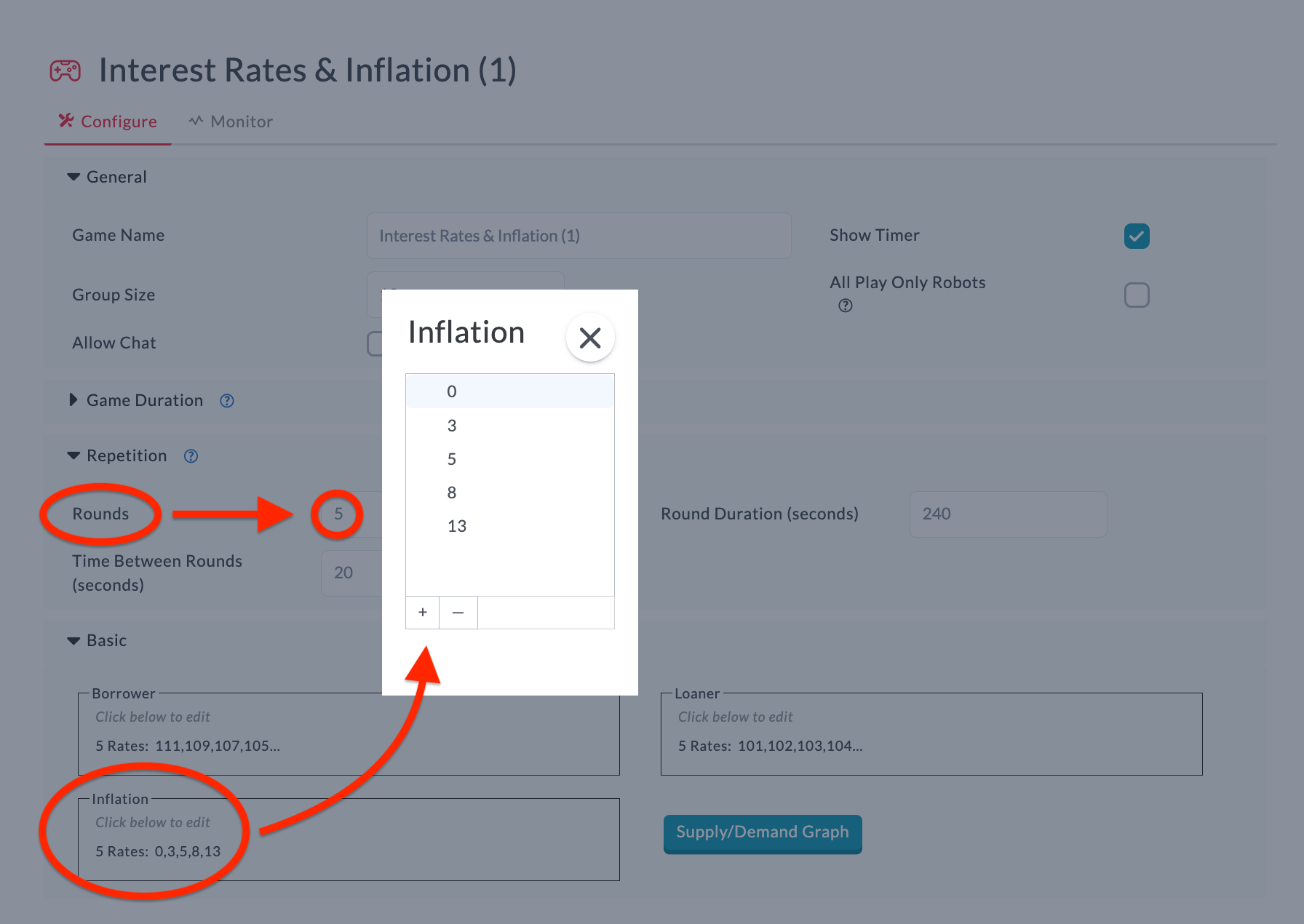

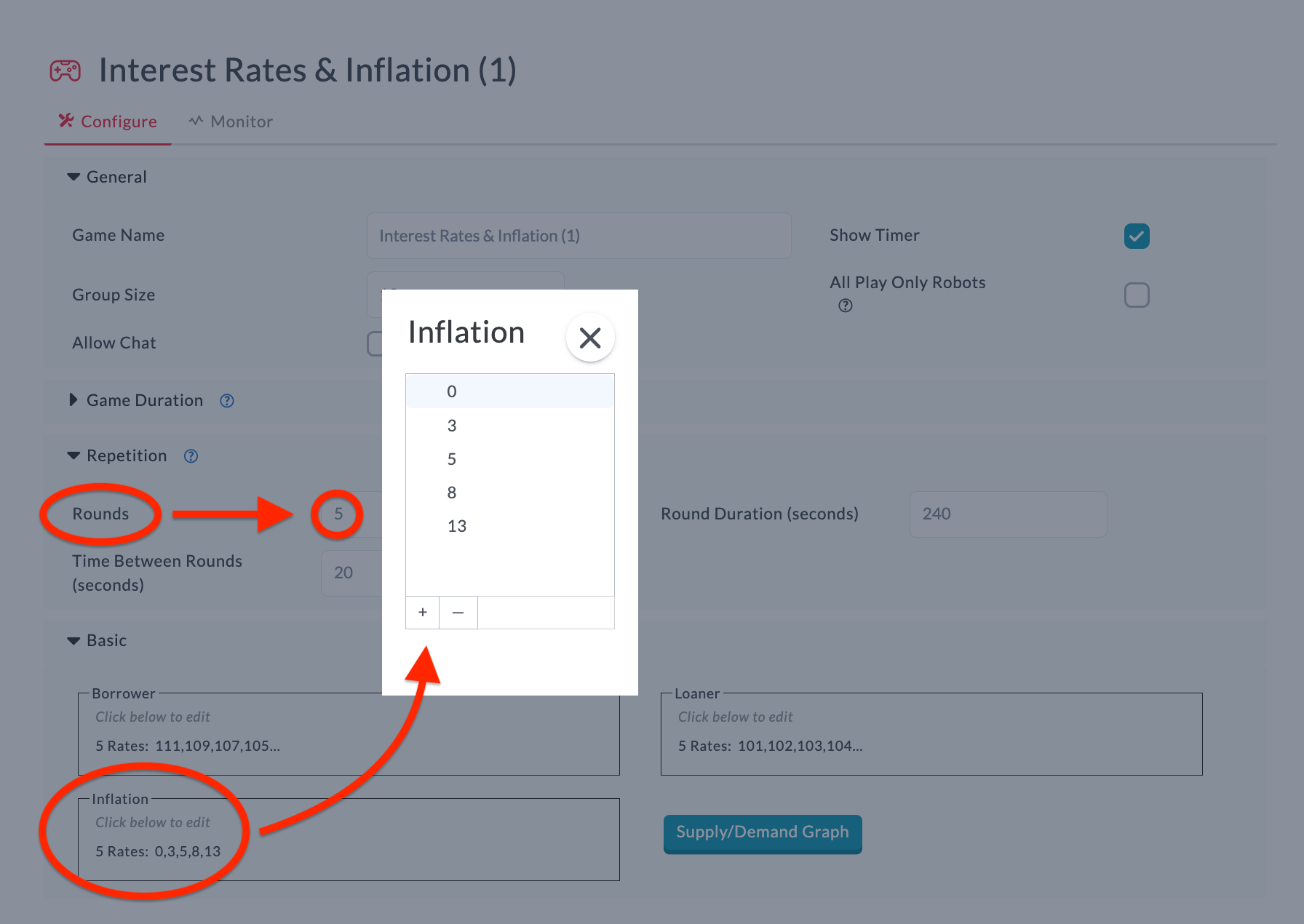

To add inflation uncertainty in your MobLab Instructor Console, go to the Configure page of the game and add inflation rates to the Inflation parameter (see image, below). Only whole numbers can be used in the Inflation parameter field (i.e. 5 = 5% rate). Also please note that each of the inflation rates you enter occur with equal probability. We suggest setting the number of Rounds to 5 or 6 so that students, who play the roles of lenders and borrowers, both get to win and lose when the actual rate of inflation does not equal the expected rate of inflation.

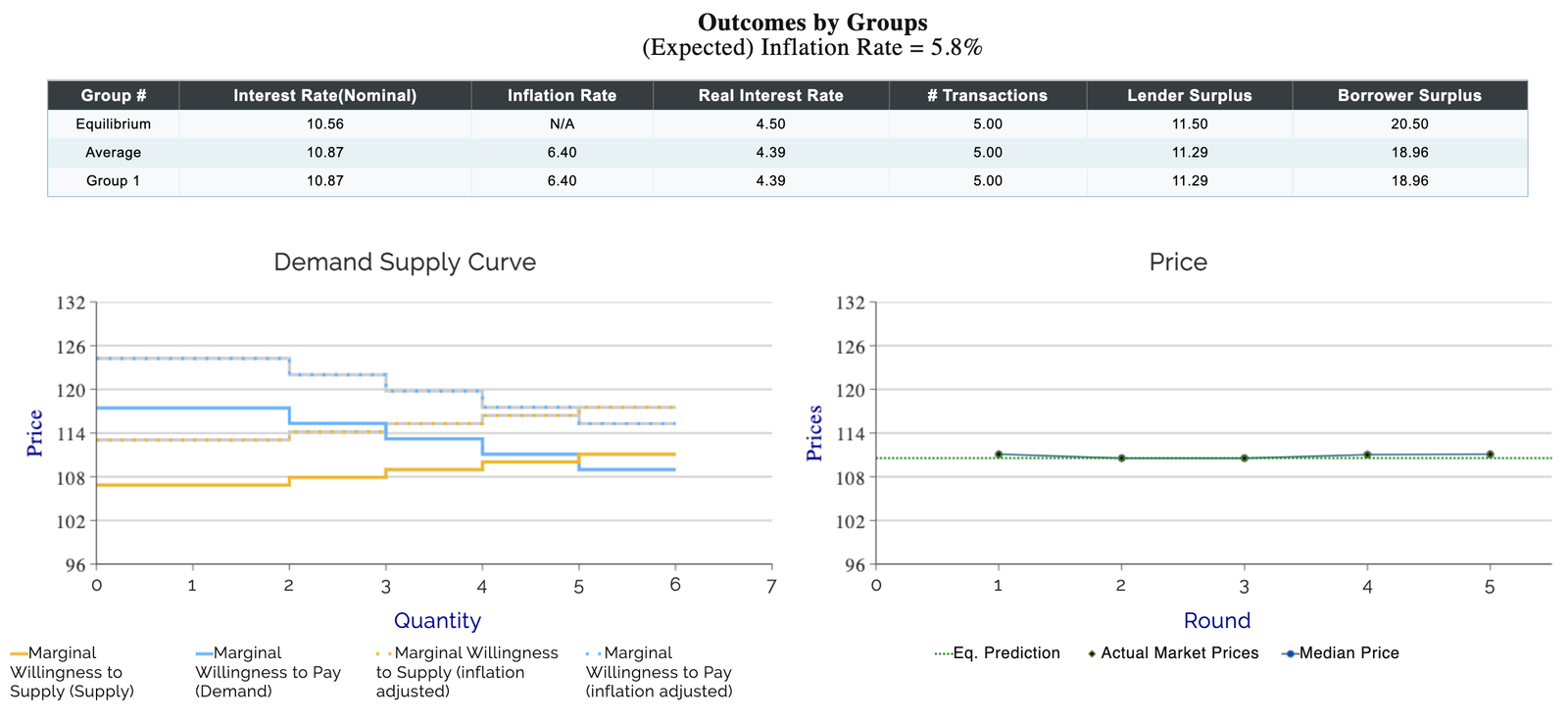

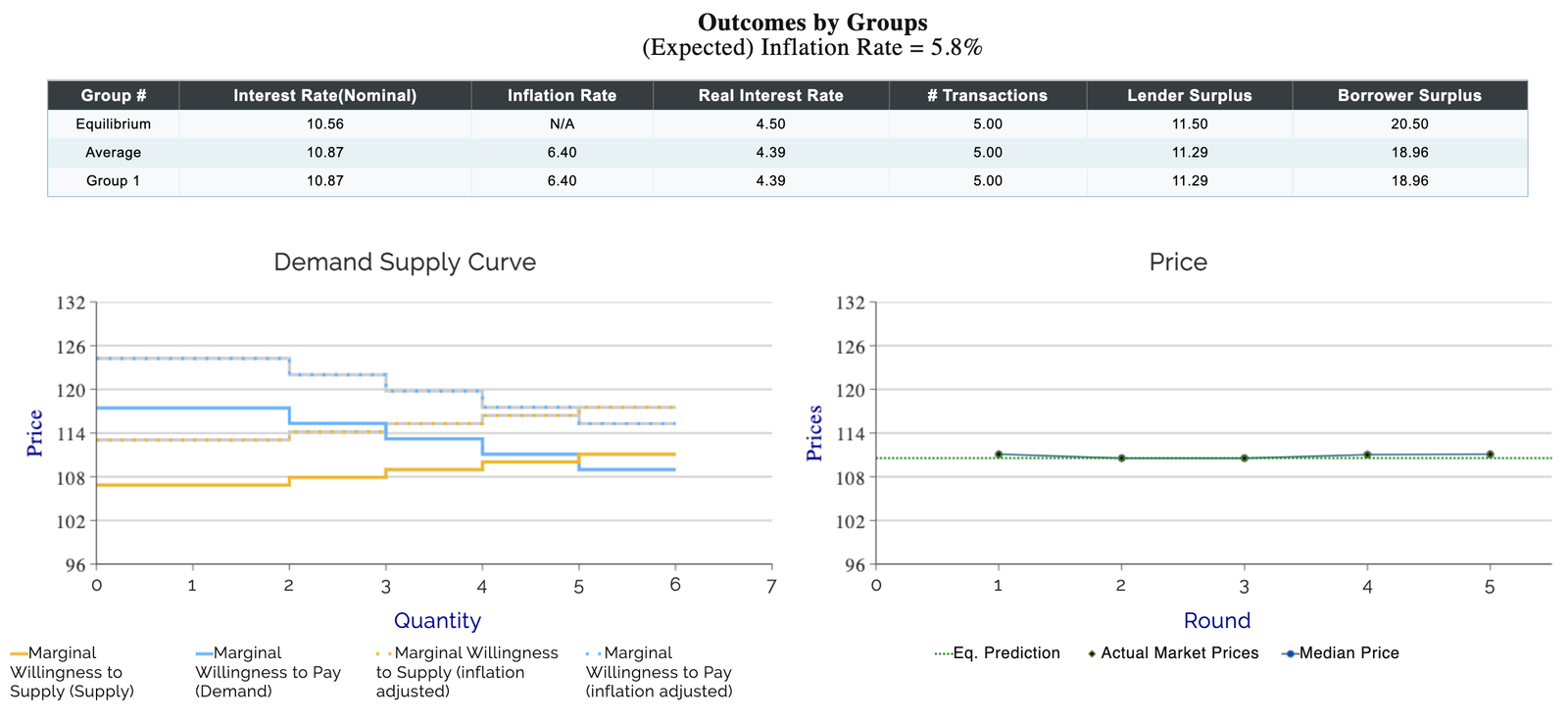

The results below show the outcome of 5 rounds of the game with (very) unpredictable inflation. Students quickly converged to a nominal interest rate of 10.87% which a considerable difference from the real interest rate. Due to the unpredictability of inflation, the real value of the loan repayment is reduced which harms lenders and benefits borrowers, as is shown in each group’s Surplus column in the image below. Much like in the real world, we expect lenders and loan underwriters in this type of environment to be risk averse, which we can infer from the results indicating a lower Lender Surplus relative to Borrower Surplus.

Interest rates and inflation may be unpredictable in today’s world, but they don’t have to be scary for students to learn. With today’s world becoming more and more impacted by monetary policy decision making and data, students can gain a better understanding of macroeconomic world around them with MobLab online economics games.

Want to see more games for macroeconomics and our platform in action? Get in touch and we would be happy to give you a personalized tour of the MobLab economics game platform.

Source: Federal Reserve Bank of St. Louis

With MobLab’s Interest Rates & Inflation game, students learn first-hand about the dynamics related to macroeconomic borrowing and lending. Each student has a private rate of return on a $100 investment, but only half of each group of students has $100. Equilibrium loan repayment amount is determined by the intersection of the lenders’ minimum acceptable and borrowers’ maximum acceptable repayment amounts. Payoff for a round (year) equals a player’s increase in real wealth.

No, we are not mining for crypto here, but check out our Centipede game if you’re teaching about crypto in the classroom.

We previously published an excellent MobLab blog post that summarizes the Interest Rates and Inflation game, but in this post we will focus on how you can apply uncertainty to inflation by setting multiple interest rates. Why use uncertainty? Applying uncertainty by changing a few simple parameters in the Interest Rates and Inflation game is a great way to mirror the macro environment we live in today for students to better relate.

To add inflation uncertainty in your MobLab Instructor Console, go to the Configure page of the game and add inflation rates to the Inflation parameter (see image, below). Only whole numbers can be used in the Inflation parameter field (i.e. 5 = 5% rate). Also please note that each of the inflation rates you enter occur with equal probability. We suggest setting the number of Rounds to 5 or 6 so that students, who play the roles of lenders and borrowers, both get to win and lose when the actual rate of inflation does not equal the expected rate of inflation.

Adding inflation uncertainty to MobLab’s Interest Rates & Inflation Game. Due to the wide inflation rate range of 0 to 13, this example introduces a lot of inflation uncertainty. If we wanted less inflation uncertainty, we could reduce the range by inputting 2, 3, 5, and 6 as the inflation rates, for example.

The results below show the outcome of 5 rounds of the game with (very) unpredictable inflation. Students quickly converged to a nominal interest rate of 10.87% which a considerable difference from the real interest rate. Due to the unpredictability of inflation, the real value of the loan repayment is reduced which harms lenders and benefits borrowers, as is shown in each group’s Surplus column in the image below. Much like in the real world, we expect lenders and loan underwriters in this type of environment to be risk averse, which we can infer from the results indicating a lower Lender Surplus relative to Borrower Surplus.

Sample results and data from 5 rounds of borrowing and lending with (very) unpredictable interest rates. In this example, borrowers benefit more than lenders.

Interest rates and inflation may be unpredictable in today’s world, but they don’t have to be scary for students to learn. With today’s world becoming more and more impacted by monetary policy decision making and data, students can gain a better understanding of macroeconomic world around them with MobLab online economics games.

Want to see more games for macroeconomics and our platform in action? Get in touch and we would be happy to give you a personalized tour of the MobLab economics game platform.